Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

market analysis

The gold change window is open! Institutions are quietly making arrangements, and retail investors are paying close attention to these three signals.

Wonderful introduction:

The moon waxes and wanes, people have joys and sorrows, life changes, and the year has four seasons. If you survive the long night, you can see the dawn, if you endure the pain, you can have happiness, if you endure the cold winter, you no longer need to hibernate, and after the cold plums have fallen, you can look forward to the new year.

Hello everyone, today XM Forex will bring you "[XM Group]: The gold trading window is open! Institutions are quietly making arrangements, and retail investors are paying close attention to these three signals." Hope this helps you! The original content is as follows:

On Wednesday (November 12) during the Asia-Europe period, the trend of spot gold maintained the shock pattern of Tuesday with an amplitude of US$50. It is currently trading around US$4,126, which is almost the same as the opening. On Tuesday and Wednesday, the price of gold showed both positive and negative trends (the U.S. private ADP data was disappointing) and negative (the U.S. government shutdown is expected to be lifted), suggesting that the unilateral upward trend may turn into range-bound fluctuations. Insights into these core dynamics can provide key reference for predicting whether this round of gains can continue. This analysis will deeply dismantle the underlying logic of today's price fluctuations, accurately assess market sentiment, and explore the potential impact of gold's market outlook.

The core driver of the recent surge in gold prices

Economic uncertainty is one of the core pillars driving the rise in gold prices. Whether the AI narrative can convert large amounts of capital investment into corporate income, whether the decline in labor market data is a long-term structural labor shortage or a cyclical corporate job shortage can be solved through interest rate cuts, and the continued fermentation of the U.S. government shutdown are all points that will generate pulse-like growth in gold demand. When traditional market confidence weakens, it is a critical window period for gold to exert its safe-haven properties. The allocation value of gold as a classic safe haven is highlighted.

The monetary policies and interest rate decisions of various central banks play a decisive role in the price of gold. The recent statements by the Federal Reserve and other major central banks have released some signals of maintaining low interest rates for a long time, which will directly strengthen the attractiveness of gold allocation.

A low interest rate environment will significantly reduce the opportunity cost of holding non-interest-bearing assets such as gold. If the market forms a consensus expectation that the low interest rate cycle will continue, buying power will continue to accumulate.

The performance of the U.S. dollar index has a typical negative correlation with the price of gold. dollar nearlyThe weakening period reduces the cost of gold purchases by holders of non-U.S. currencies, directly activating global demand for gold. Fluctuations in the strength of the U.S. dollar usually trigger reverse adjustments in gold prices. If the U.S. dollar index shows a weak trend today, this will undoubtedly be one of the core drivers of this round of gold price increases.

How long can the bullish market sentiment last?

Gold investment demand has shown a significant increase. Exchange-traded funds (ETFs) that track gold prices continue to record net inflows, reflecting that institutional investors are hedging portfolio risks through gold instruments.

But the question is how long the inflow of funds can last, and whether more funds will flow out due to gold's rebound.

The recent rebound in gold is technically a position to reduce positions. The current price is chasing higher and the cost-effectiveness of adding more gold will not be very high.

However, although the price/performance ratio is not high, investor sentiment can be heated up by the bullish consensus of analysts and market xmxyly.commentators, which will form a positive feedback mechanism. Positive media reports and analysts raising target price ratings will continue to strengthen the market's bullish confidence in gold and provide emotional support for the continuation of the rally.

Can gold’s rally continue?

Although gold shows a clear bullish pattern in the short term, a number of short-term variables may still disturb its trend trajectory.

First of all, the U.S. government shutdown is about to end, which is clearly positive for the U.S. dollar index, but will it cause the U.S. dollar index to start to rebound? If the U.S. dollar index starts to rebound early, will there be a trend of a correction of the U.S. dollar index on the day when the shutdown ends?

Or if the U.S. government shutdown ends and gold does not fall, gold is expected to maintain a strong upward rhythm.

That is, if there is a public signal of stabilization in the market, we can trade the gold in our hands in the direction of the news, but we must always pay attention to the deviation of the trend from the actual news to prevent us from missing good buying and selling points when the market honors the news.

To study and judge the long-term trend of gold, it is necessary to anchor core macroeconomic variables. If inflationary pressures remain high and global economic growth momentum weakens, the long-term allocation value of gold will continue to be highlighted.

In addition, under the general trend of global investment portfolios transforming towards sustainable and renewable assets, gold, as a traditional hedging and value-added tool, may have xmxyly.comparative advantages over traditional stocks, bonds and other assets.

Focus on this, investors need to focus on tracking the three core levels

At the interest rate level, subsequent policy statements from central banks will become the core variable that shapes market expectations. xmxyly.combined with the actual interest rate obtained from inflation data, the lower the actual interest rate, the more suitable it is to hold gold, which is the extent of the Fed's subsequent interest rate cut.

In terms of the strength of the US dollar, closely tracking the trend of the US dollar index against a basket of currencies can predict the direction of gold price fluctuations in advance, that is, US labor and inflation data, and the end time of the government shutdown.

In terms of geopolitical dynamics, any sudden changes in the geopolitical landscape may trigger short-term violent fluctuations in gold prices, such as conflicts between Russia and Ukraine, conflicts between Palestine and Israel, and trade frictions initiated by the United States.

Of course, as the main driver of recent gold fluctuations, ETFs reflect market sentiment and the tendencies of global investors. They can also be grasped through technical analysis to gain trading opportunities.

Conclusion and technical analysis:

To sum up, the volatile trend of gold on Wednesday is a temporary balance under the interweaving of long and short factors.

The core driving force for this round of gold price increases stems from the demand for hedging amid economic uncertainty, the dovish interest rate expectations of major central banks, and the cost advantage brought about by the weakening of the US dollar.

Although the market's bullish sentiment has been strengthened by ETF inflows and analyst opinions, the pursuit of high cost performance at the current price has caused doubts.

For the market outlook, the sustainability of gold’s rally will face a key test. Investors need to focus on three core variables: first, the real interest rate, which directly determines the opportunity cost of holding gold; second, the trend of the U.S. dollar index, whose negative correlation with gold prices is the key to short-term fluctuations; third, geopolitical and other risk events, which may trigger sudden fluctuations.

In terms of operation, it is recommended to closely track the market's reaction to news (such as the follow-up to the US government shutdown) - if the gold price does not fall after the good news is realized, or the gold price does not rise after the bad news appears, it is an important signal to judge the true strength of the market.

In the short-term strong pattern, it is necessary to remain vigilant about the technical aspects, and while following the trend, beware of the risk of market reversal after the news is realized. In the long term, against the background of high global economic and policy uncertainty, the allocation value of gold remains stable.

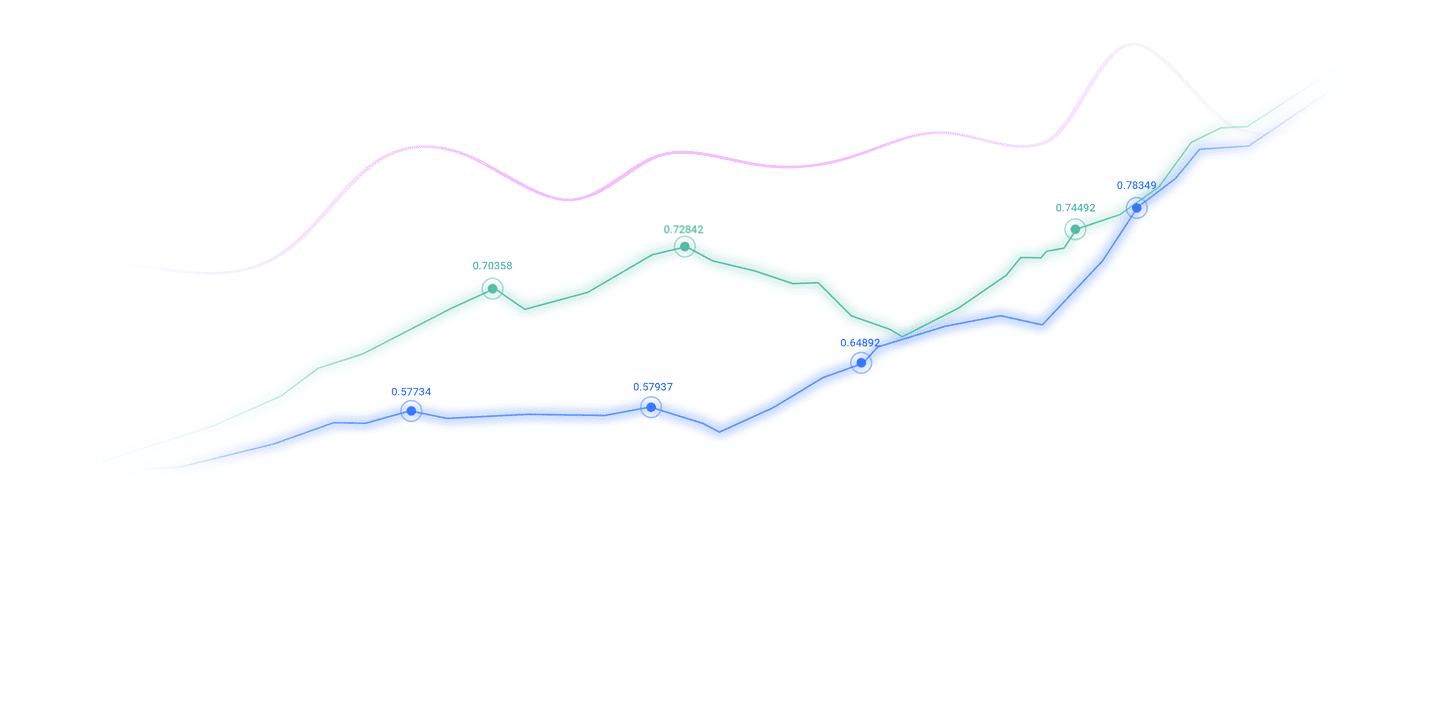

Technically, it can be seen from the spot gold daily line that the price of gold has recently formed an upward channel. In addition to the 4100 integer mark, the middle track of the channel and near 4060 are the two nearest supports, while the vicinity of 4157 is the key pressure level. Therefore, this pressure level and the fan-shaped area surrounded by the upper track of the upward channel have become important observations for observing the strength of gold's rebound.

The above content is all about "[XM Group]: The gold trading window is open! Institutions are quietly making arrangements, and retail investors are paying close attention to these three signals." It was carefully xmxyly.compiled and edited by the XM foreign exchange editor. I hope it will be helpful to your trading! Thanks for the support!

Every successful person has a beginning. Only by having the courage to start can you find the way to success. Read the next article now!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here