Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- Note that gold will usher in a big market!

- Bank of England's interest rate decision is coming, mainstream expectations cut

- The darkest moment in the euro zone!市场做空欧元,押注历史性崩盘

- The bullish gold is like a rainbow, with a sword aiming at 3500?

- A collection of positive and negative news that affects the foreign exchange mar

market news

Gold has not yet completely corrected, and there is still a risk of falling below 4100

Wonderful introduction:

If the sea loses the rolling of huge waves, it will lose its majesty; if the desert loses the wild dance of flying sand, it will lose its magnificence; if life loses its true course, it will lose its meaning.

Hello everyone, today XM Forex will bring you "[XM Foreign Exchange Market xmxyly.commentary]: Gold has not yet xmxyly.completely corrected, and there is still a risk of falling below 4100." Hope this helps you! The original content is as follows:

Zheng’s Point of View: Gold has not yet xmxyly.completely corrected, and there is still a risk of falling below 4100

Reviewing yesterday’s market trend and technical points that emerged:

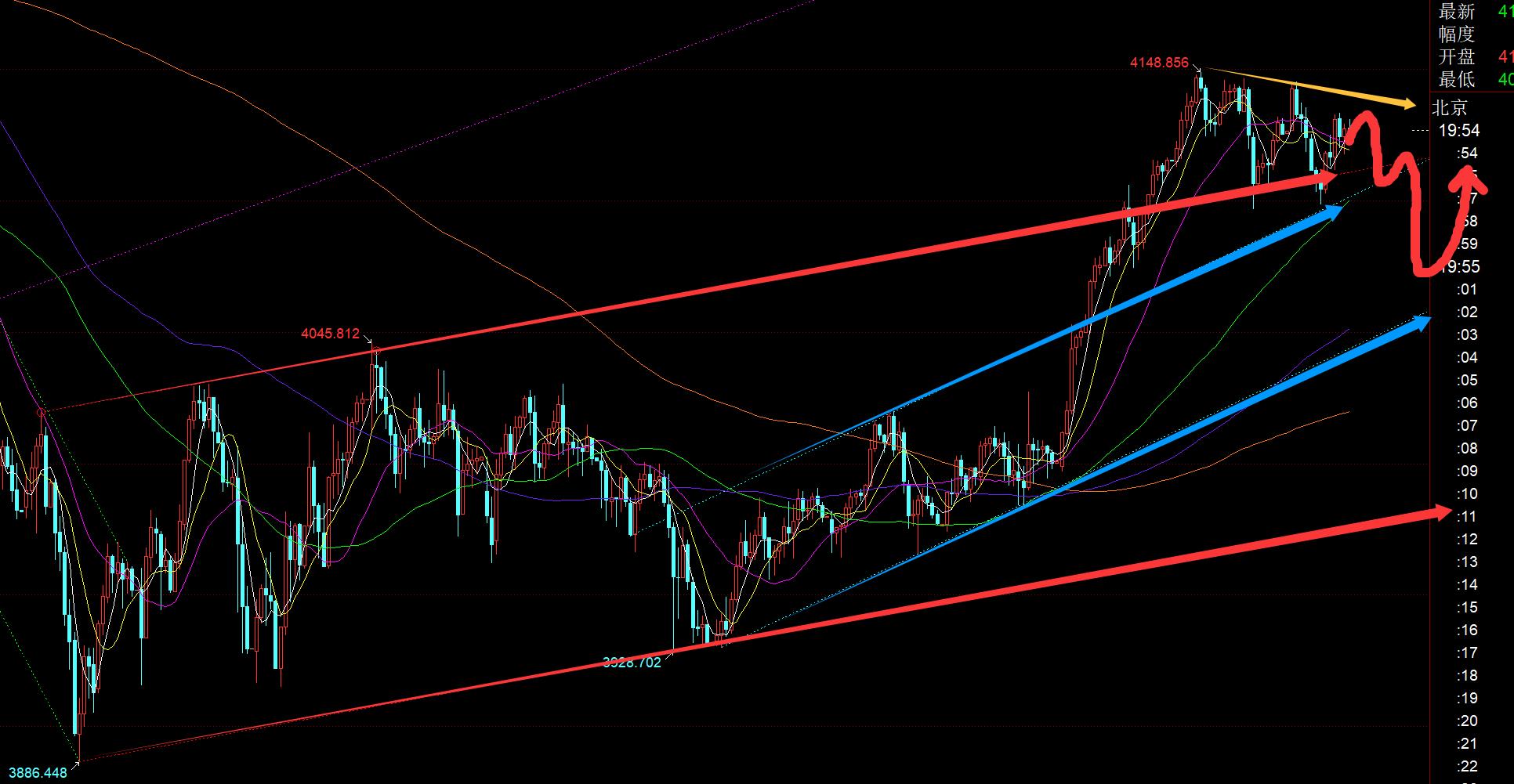

< p> First, in terms of gold: Yesterday, the Asian market continued to rise strongly, and then it stepped back slightly in the afternoon and relied on 4133 to follow the bullish trend. It reached 4144 to indicate profits, and it also reminded that if the European market breaks through the intraday high and continues to rise, There is still a second rise in the U.S. market; however, the high level has been maintained before the U.S. market has not broken through a new high, so it is not appropriate to blindly follow the rise at high levels; the evening research report pointed out that pay attention to the hourly line on the 10th, once it effectively falls, the short squeeze will end, which will bring about short-term After a wave of downward correction, the line finally fell to 4096, and then stabilized and reversed in the middle of the night; in fact, from the daily level, the 4096 position has not been corrected in place, at least the mid-track 4085 line needs to be stepped back to confirm;Second, in terms of silver: The trend of silver has been significantly stronger than that of gold in the past two days. After the daily Yang broke through the middle track, it continued the positive streak and quickly reached the expected second high of at least 51, and then it went up to 52.5. This height may be tested; but it should also be noted that its daily mid-track has not stepped back and corrected, which is a certain foreshadowing for the market outlook;

Today's market analysis and interpretation:

First, the gold daily level: Yesterday it closed at Xiaoyang. After the sharp rise in Yang the day before, it started to stagnate, or began to fluctuate sideways, or there was a wave of downward correction; at least the mid-rail 4085 line needs to be stepped back to confirm, and once it falls to 4 085, it is estimated that the 4066 line may also be tested today on the 5th; as for the top-bottom switching position 4045-40 support, it is difficult to say for the time being. It can confirm the middle track or pull up a wave after the 5th and then go down to test the top and bottom levels.Position, you can also test the top and bottom position in one go and then pull up; but for the latter, it may destroy the conventional five-wave rising pattern; therefore, you tend to step back to confirm the support of the middle rail or the 5-day moving average, then stabilize and fluctuate to pull up a wave to reach a sub-high point of 4192-4200, the limit is 4275, and then rush higher and fall back to confirm the bottom support. Slowly The slow expansion will lead to a large convergence triangle, and finally, through time-for-space, it will reach a new historical high at the end of the year or early next year to continue the bull market;

Second, the golden 4-hour level: the current 5th and 10th are bonded, there is no obvious direction guidance, it is sorting at a high level, and the mid-track support moves up to 4080;

Third, the golden hourly level: it stabilized overnight at 4097 and bottomed out. It opened up this morning, but it was still under pressure from the previous day's high of 4145-47 and then fell back. When there is a continuous negative trend and the big negative pressure falls below the 10-day and mid-rail support, it means that there will be a wave of downward pressure, and finally there will be another wave of downward pressure. It hit the overnight low of 4097 for the first time; before the European market, driven by silver breaking through this week's new high, gold also quickly bottomed out from its original weak decline and counterattacked, but judging from the current trend, it is still a bit weak; tonight, pay attention to the mid-rail 4122 line. Once the Great Yin loses it, it will repeatedly test 4100-409 7 is also the upper track confirmation point of the blue channel in the figure and the 66-day moving average support level. If you test 4097-98 for the third time, you may not be able to stop it. If it fails, it will trigger a short-term accelerated downward trend. Look at 4085 and 4066. It is best not to go to 4045 in one go. After pulling down and stabilizing, you can welcome a wave of shocks upward. OK, that is to say, this wave of decline can be basically restored, so that we can accumulate strength and hit the second high again; therefore, under the resistance of 4145 tonight, pay attention to the suppression of 4140-41, or after effectively breaking the mid-rail, the rebound confirms the suppression downward, and pay attention to stabilization at the low level of 4066;

Silver: From the picture above, although the Asian and European markets are relatively strong, Lianyang has reached new highs in the past few days and temporarily broke through the upper track of the red channel; however, the severe top divergence of short-term macd, coupled with the fact that the low has not been xmxyly.completely repaired, and the drag of gold, may It will cause silver to suddenly turn around and fall back for a wave. Once it returns to the red channel, the day's high will be effectively under pressure. For support below, pay attention to the upper track of the blue channel of 50.7, 50, and the strong support of 49.5. If it pulls down and stabilizes, it will continue to be bullish;

Crude oil: It is treated as a shock, the space is relatively small, and it moves slowly. The upper track of the channel is under pressure and falls back. Tonight, focus on the 60.2 support, and if it fails, pay attention to 59.8-59.6, if it continues, it will open up space and gradually point to the down track;

The above are several views of the author's technical analysis. As a reference, it is also a summary of the technical experience accumulated by watching and reviewing the market for more than 12 hours a day for twelve years. Technical points will be disclosed every day, with text and video interpretation. Friends who want to learn can xmxyly.compare and reference based on the actual trend; those who agree with the idea can refer to the operation, take good defense, and risk control first; those who do not agree should be treated as such. Just let it pass; thank you all for your support and attention;

[The opinions of the article are for reference only, investment is risky, and you need to be cautious when entering the market, operate rationally, strictly set losses, control positions, risk control first, and be responsible for profits and losses]

Writer: Zheng's Dianyin

Reading and researching the market for more than 12 hours a day, persisting for ten years, detailed technical interpretations are made public on the entire network, and serve with sincerity, dedication, sincerity, perseverance, and wholehearted service to the end! Write xmxyly.comments on major financial websites! Proficient in the K-line rule, channel rule, time rule, moving average rule, segmentation rule, top-bottom rule; student cooperation registration hotline - WeChat: zdf289984986

The above content is all about "[XM Foreign Exchange Market xmxyly.commentary]: Gold has not been xmxyly.completely corrected, and there is still a risk of falling below 4100". It is carefully xmxyly.compiled and edited by the XM foreign exchange editor. I hope it will be helpful to your trading! Thanks for the support!

Sharing is as simple as a gust of wind can bring refreshing, as pure as a flower can bring fragrance. Gradually my dusty heart opened up, and I understood that sharing is actually as simple as the technology.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here