Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- The non-agricultural outburst triggered an epic charge of gold, and the dollar b

- 7.25 Gold four-hour adjustment ends, and it is expected to restart and rise with

- A collection of positive and negative news that affects the foreign exchange mar

- The Federal Reserve cut interest rate bets in September, and Europe supports Ukr

- Analysis of the latest trends of gold, USD index, yen, euro, pound, Australian d

market news

The U.S. dollar index first rose and then fell, the U.S. government shutdown is about to end

Wonderful introduction:

Without the depth of the blue sky, you can have the elegance of white clouds; without the magnificence of the sea, you can have the elegance of the creek; without the fragrance of the wilderness, you can have the greenness of the grass. There is no bystander seat in life. We can always find our own position, our own light source, and our own voice.

Hello everyone, today XM Forex will bring you "[XM Group]: The U.S. dollar index first rose and then fell, and the U.S. government shutdown is about to end." Hope this helps you! The original content is as follows:

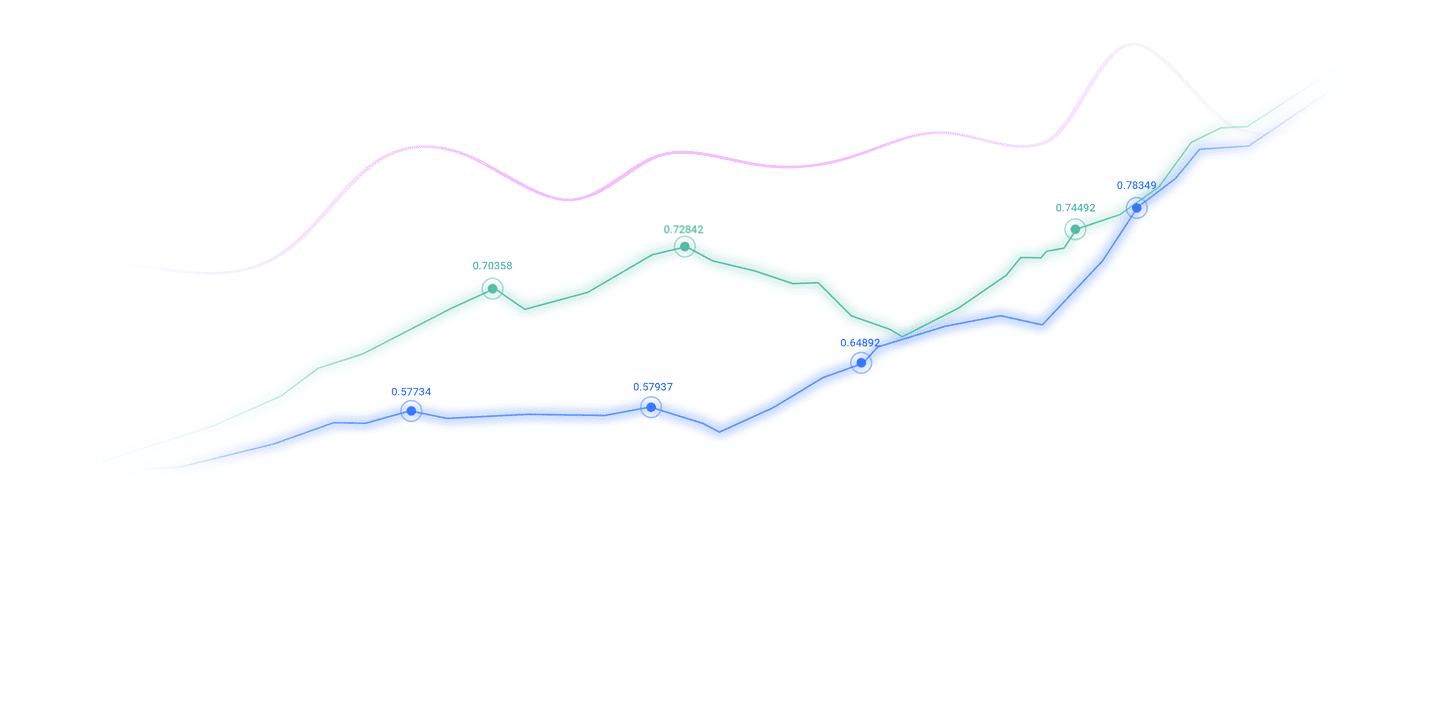

On November 13, spot gold was trading around US$4,195/oz in the Asian market on Thursday. The price of gold rose strongly on Thursday. Spot gold hit a new high since October 21st, reaching US$4,211.65/oz, affected by U.S. Treasury yields. Driven by the decline and increased expectations of a rate cut by the Federal Reserve; U.S. crude oil traded around $58.30 per barrel. Oil prices fell more than 4% on Thursday, mainly affected by a report released by OPEC predicting that global oil supply will be equal to demand in 2026, which marks a further shift in its forecast from supply shortage to supply and demand balance.

The dollar fell slightly against the euro on Wednesday as traders assessed the potential impact on Federal Reserve policy of a slew of economic data due to be released after the U.S. government shutdown ends. Meanwhile, the yen fell to its lowest level in nine months against the dollar on concerns that Japan's new government could pressure the central bank to delay raising interest rates.

The euro rose 0.04% against the US dollar to US$1.1585; the US dollar index edged up 0.05% to 99.50, and the yen weakened as Japanese Prime Minister Sanae Takaichi made it clear that he preferred to maintain low interest rates and requested close policy coordination with the central bank.

The U.S. government will release a backlog of economic data after the shutdown ends, but the White House warned that the October employment and inflation reports may be permanently missing.

The probability of the Federal Reserve cutting interest rates in December remains at 65%, but there are internal differences on the policy path. Atlanta Fed President Bostic expressed his preference to keep interest rates unchanged and announced that he would retire in 2026. The market expects that the release of data may trigger sharp fluctuations in the foreign exchange market, and the Japanese government's measures to strengthen coordination with the central bank have intensified the pressure on the yen to depreciate.

OthersNoteworthy developments include the U.S. Supreme Court set to hear Trump's attempt to oust Federal Reserve Governor Cook in January, and the Treasury Secretary's announcement of new measures to lower the price of imported goods.

Asian Markets

BoJ Governor Kazuo Ueda said in parliament today that Japan's inflation rate is gradually becoming consistent with the central bank's 2% target, supported by improved wages and stable domestic demand. He reiterated that the BOJ aims for benign inflation accompanied by rising incomes and an improving economy, rather than price increases driven solely by import costs or temporary shocks.

Ueda noted that while demand for food and other non-durable goods has softened, household consumption remains resilient due to rising incomes and a tight labor market. He stressed that stronger wage growth would help sustain a moderate cycle of price and wage increases - an important prerequisite for durable inflation within the BOJ's framework.

Underlying inflation, which strips out the volatility xmxyly.component, is gradually accelerating towards the 2% target, driven not only by food but also by higher prices for broader goods and services, he added.

Data from the Bank of Japan showed that Japan’s corporate xmxyly.commodity price index rose by 2.7% year-on-year in October, slightly lower than the 2.8% in September, but exceeding expectations of 2.5%.

It is worth noting that the import price index in yen fell by -1.5% year-on-year, falling for the ninth consecutive month. The continued decline suggests that yen weakness is not translating into new cost-push inflation - contradicting the classic currency-inflation link.

The Australian labor market strengthened again in October, with the number of employed people increasing by 42.2 people, more than double market expectations of 20.3 people. The increase was driven by a 55.3k surge in full-time jobs, partially offset by a -13.1k drop in part-time jobs, highlighting the solid expansion of higher quality jobs.

The unemployment rate unexpectedly dropped from 4.5% to 4.3%, beating expectations of 4.4%, while the participation rate held steady at 67.0%. At the same time, monthly working hours increased by 0.5% month-on-month, further highlighting the potential elasticity of labor demand.

The upbeat data reiterated the resilience of Australia's labor market and encouraged the Reserve Bank of Australia to maintain its current cautious tone rather than shift quickly to easing policy. With inflationary pressures lingering and employment remaining firm, the RBA may wait for clearer signs of easing before signaling a rate cut, keeping February as the earliest window for policy adjustments.

European Markets

Isabelle Schnabel, a member of the European Central Bank's executive board, said interest rates were "in a good position", suggesting there was no need for an immediate change in policy as long as a major shock was avoided. "If it's not a big shock, I'll be very relaxed," she said at a conference today.

Still, Schnabel warned that inflation risks are "a little bit tilted upward." "Services sector inflation is a little higher than we thought,"she noted, adding that pay pressures were cooling "slower than expected."

Schnabel also pointed to signs that the euro zone economy is recovering faster than feared, pointing to October's improving PMI as evidence that growth momentum is picking up even as the United States raises tariffs.

"My narrative is that the economy is recovering and the output gap is closing," she said.

U.S. Market

Scalise, the majority leader of the U.S. House of Representatives, revealed that the House of Representatives will hold a full house vote on a bill to end the government shutdown at 8:00 on the 13th, Beijing time.

The U.S. Supreme Court will hold an oral argument on Trump’s request to fire Federal Reserve Governor Cook on January 21 next year.

White House: October non-farm and inflation data may never be released.

White House official Hassett: He hopes the Fed will cut interest rates by 50 basis points, but is expected to only cut interest rates by 25 basis points. If necessary, he will accept the position of Fed Chairman.

Atlanta Fed President Bostic unexpectedly announced that he will retire in February next year. Hours later, he reiterated his hawkish stance. The market is optimistic that a dove will take over his position under Trump.

New York Fed President Williams: The time to restart bond purchases is getting closer (SOMA managers also hold the same view), but this is only a technical measure.

"Federal Reserve Speaker" Nick Timiraos pointed out that the four local Fed chairmen with voting rights are not enthusiastic about cutting interest rates again in December. Boston Fed President Collins: The Fed is likely to keep interest rates at current levels for some time. The labor market has not deteriorated, and it is necessary to ensure that inflation returns to 2% sustainably before cutting interest rates.

The above content is all about "[XM Group]: The U.S. dollar index rose first and then fell, the U.S. government shutdown is about to end". It was carefully xmxyly.compiled and edited by the XM foreign exchange editor. I hope it will be helpful to your trading! Thanks for the support!

Live in the present and don’t waste your present life by missing the past or looking forward to the future.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here