Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- Even if the dollar weakens, it cannot be saved? Pound is hit hard by expectation

- The daily line has a big negative support, gold and silver are short first and t

- Expectations of interest rate cuts in September are solid! The US dollar is test

- A collection of positive and negative news that affects the foreign exchange mar

- The golden step-by-step rises, and we are expected to stand firm tonight and mak

market analysis

The U.S. government ends its longest shutdown, and the Fed’s hawkish signal suppresses gold prices! Europe accelerates financial autonomy

Wonderful introduction:

Without the depth of the blue sky, you can have the elegance of white clouds; without the magnificence of the sea, you can have the elegance of the creek; without the fragrance of the wilderness, you can have the greenness of the grass. There is no bystander seat in life. We can always find our own position, our own light source, and our own voice.

Hello everyone, today XM Forex will bring you "[XM Forex]: The US government ends the longest shutdown, the Fed's hawkish signal suppresses gold prices! Europe accelerates financial independence". Hope this helps you! The original content is as follows:

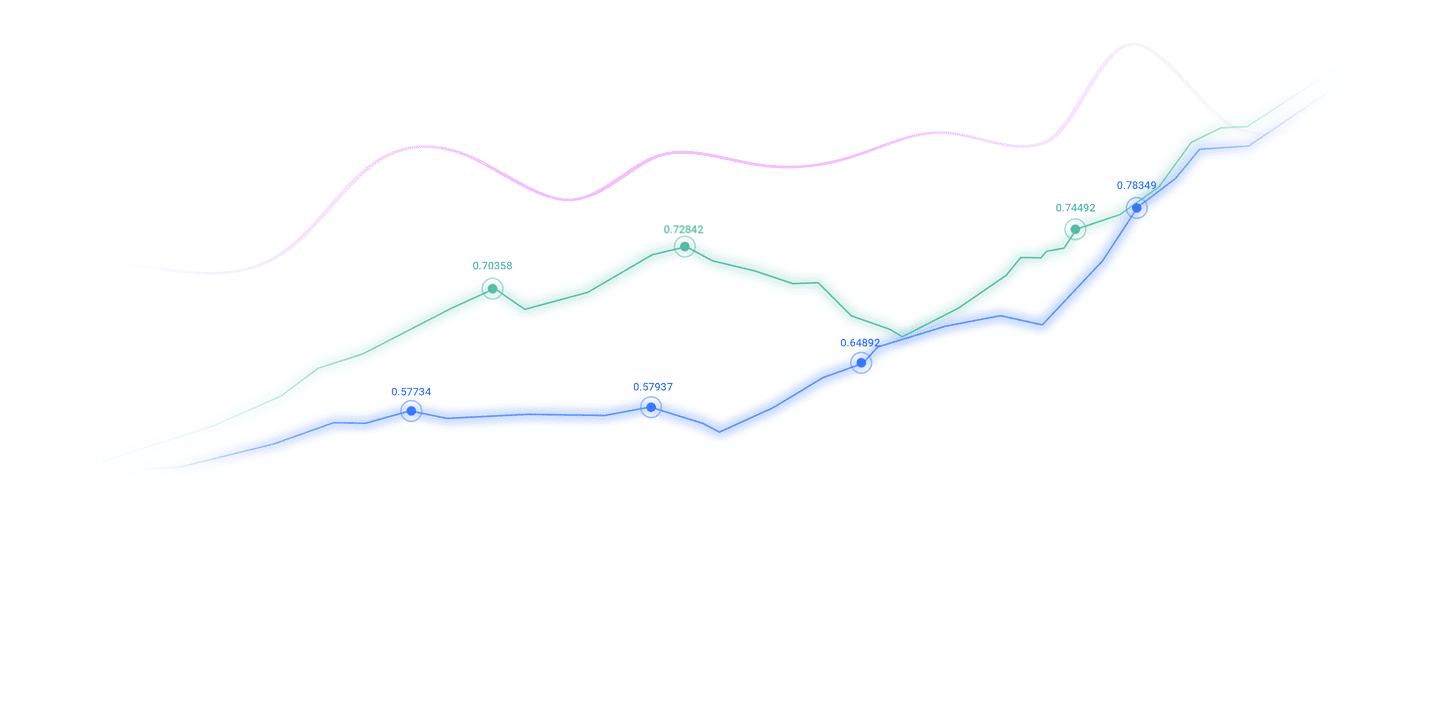

On November 14, in early Asian trading on Friday, Beijing time, the U.S. dollar index was hovering around 99.24. On Thursday, as the U.S. government reopened, the U.S. dollar index continued to decline, once falling below the 99 mark, and finally closed down 0.29% at 99.18; the benchmark 10-year U.S. bond yield finally closed at 4.126%, and the 2-year U.S. bond yield, which is sensitive to the Federal Reserve's policy interest rate, closed at 3.603 %; Spot gold rose first and then fell. It once rushed above the 4240 mark before the U.S. market, but then fell sharply and gave up all the gains during the day, and finally closed down 0.55%, at $4171.51 per ounce; spot silver finally closed down 1.85%, at $52.27 per ounce. After plummeting 4% in the previous trading day, crude oil prices fluctuated at the bottom. WTI crude oil remained volatile throughout the day, finally closing up 0.12% at US$58.51/barrel; Brent crude oil finally closed up 0.22% at US$62.57/barrel.

Analysis of major currency trends

U.S. dollar index: As of press time, the U.S. dollar is hovering around 99.24. The dollar's short-term trend will depend on the quality of upcoming economic data and clarity on the Fed's policy path. The statistical gaps caused by the government shutdown may continue to affect the market's judgment on the health of the U.S. economy and bring uncertainty to exchange rate fluctuations. Technically, the nearest support level for the U.S. dollar index is in the 98.85–99.00 range. If the USD Index manages to close below the 98.85 level, it will head towards the next support level at 98.00–98.15.

Gold and crude oil market trend analysis

1) Gold market trend analysis

On Friday in Asia, gold hovered around 4183.22, although the reopening of the US government has resolved short-term uncertainty. , but triggered a chain sell-off of "buying news and selling facts". The 1% drop in gold prices from a three-week high is not an isolated incident, but the result of internal disagreements in the Federal Reserve, stubborn inflation, weak bond markets and global asset rotation resonance. Weak employment is difficult to overcome concerns about inflation, and an interest rate cut in December is likely. The rate fell to 50%, and the rise in real interest rates directly affected the attractiveness of gold. In the short term, the gold bull market faces the risk of cooling down. If the Fed confirms the suspension of easing, investors need to be wary of further selling gold. However, from a long-term perspective, the data vacuum left by the shutdown, the hidden dangers of tariff inflation, and geoeconomic uncertainty will still support the core value of gold as a safe haven asset. The market is at an inflection point, and gold bulls need to wait patiently for clarity on inflation data or the triggering of new risk aversion events before restarting the upward channel.

2) Crude oil market trend analysis

On Friday’s Asian session, crude oil was trading around 59.01. The market weighed ongoing concerns about a global supply glut and potential supply disruptions from sanctions on Russia's Lukoil. Markets are simultaneously weighing conflicting signals: ongoing concerns about a global supply glut, on the one hand, and potential supply disruptions from sanctions on Russia's Lukoil, on the other. Investors will continue to focus on the actual impact of upcoming Russian oil sanctions and whether OPEC+ will make output policy adjustments in response. Oil prices are currently in a technical consolidation stage, waiting for clearer directional guidance.

Foreign exchange market trading reminder on November 14, 2025

21:30 US October retail sales monthly rate

21:30 US October PPI annual rate

21 :30 US October PPI monthly rate

22:20 Fed Bostic speaks

23:00 US September xmxyly.commercial inventory monthly rate

23:05 Fed Schmid speaks

p>

23:30 EIA natural gas inventories in the United States for the week to November 7

02:00 the next day Total oil drilling rigs in the United States for the week to November 14

At 03:30 the next day, Fed Logan participated in a meeting Fireside Chat

Federal Reserve Bostic attended a meeting at 04:20 the next day

The above content is about "[XM Foreign Exchange]: The US government ends the longest shutdown, and the Fed's hawkish signal suppresses gold prices! Europe accelerates financial independence"The entire content of this article was carefully xmxyly.compiled and edited by the editor of

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here