Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- A collection of positive and negative news that affects the foreign exchange mar

- The US dollar/Canada dollar hits a new high. What is the market driver behind it

- Follow the wait and see after three consecutive weeks of rising, and pay attenti

- The shooting star is waiting to fall, gold and silver continue to rise

- A collection of positive and negative news that affects the foreign exchange mar

market analysis

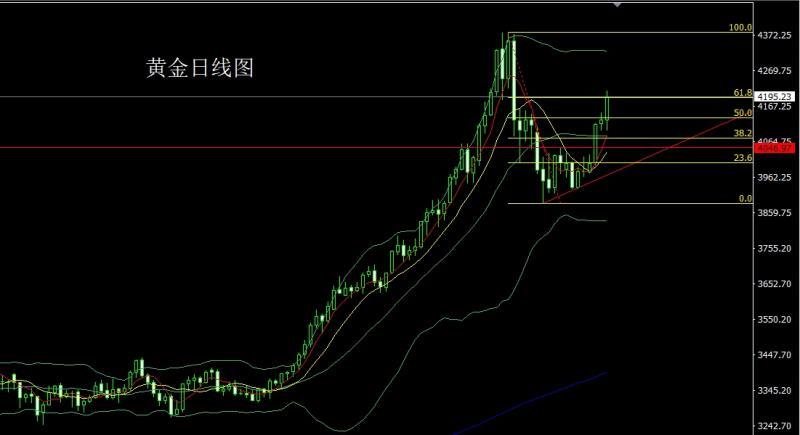

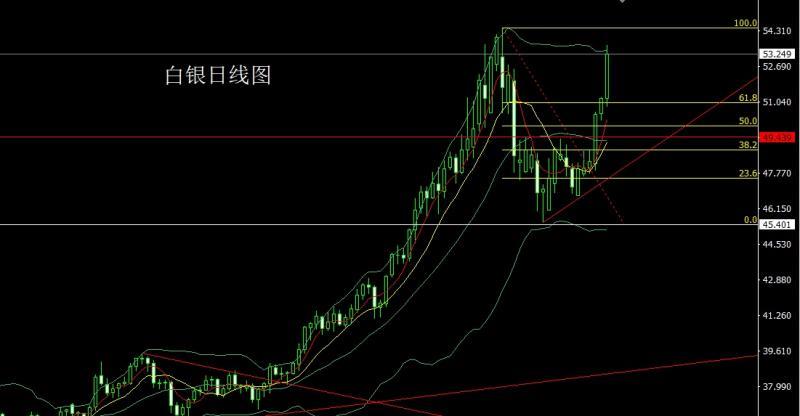

The daily line continues to break the pressure, and gold and silver are still suppressed.

Wonderful introduction:

Out of the thorns, in front of you is a broad road covered with flowers; when you climb to the top of the mountain, you will see the green mountains at your feet. In this world, if one star falls, it cannot dim the starry sky; if one flower withers, it cannot make the entire spring barren.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange]: The daily line has broken through the pressure, and there are still many gold and silver rebounds." Hope this helps you! The original content is as follows:

Yesterday, the gold market continued to rise. After opening at 4127.8 in early trading, the market first rose to a position of 4146.2 and then fell rapidly. The daily low reached a position of 4098.8. The market started to rise strongly. After the daily line broke the previous day's high, the market accelerated upward. The daily line reached the highest position of 4212.3 and then consolidated. After the daily line finally closed at the position of 4195.2, the daily line has a lower shadow line longer than the upper shadow line. The big Yang line closed, and after the end of this form, today's market went back to the long position. In terms of points, the long position of 3325 and 3322 below and the long position of 3368-3370 last week and the long position of 3377 and 3385 and the long of 3563 will be reduced. The loss follow-up is held at 3750. If it falls back to 4165 first, be conservative and stop loss at 4162 and 4157. The target is 4200 and 4212. If the position is broken, look at 1220 and 4232-4240.

Yesterday, the silver market opened at 51.205, and then the market first fell back to 50.826, and then started to rise strongly. The daily line reached the highest level of 53.667, and then consolidated, and the daily line closed. After reaching the position of 53.249, the daily line closed with a big positive line with the same length as the upper and lower shadow lines. After the xmxyly.completion of this form, the long position of 37.8 below and the long position of 38.8 followed up at 42. After yesterday's long position reduction of 50.9, the stop loss followed up at 51.2.Hold, today 52.3 is long, stop loss is 52, target is 53.2, 53.5 and 53.7, break position is 54 and 54.3.

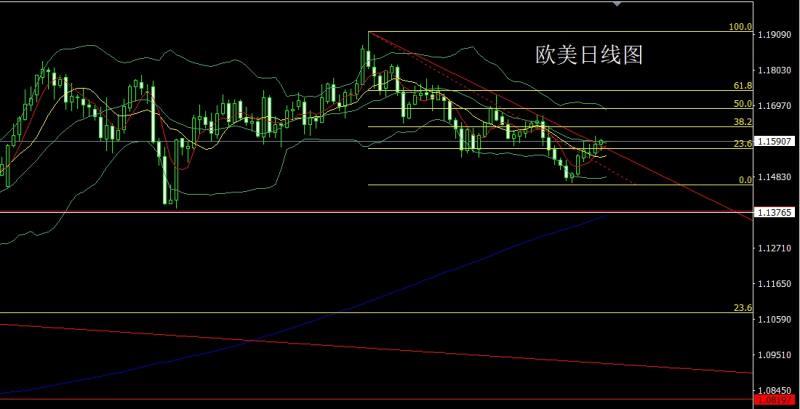

European and American markets opened at 1.15827 yesterday, and then the market fell back to 1.15617 and then rose strongly. The daily line reached the highest position of 1.15973 and then consolidated. After the daily line finally closed at 1.15919, the daily line closed at 1.15919. The hammer head pattern with a long lower shadow line closes, and after such a pattern ends, the daily line effectively breaks the pressure. At the point, today's stop loss is 1.15550, which is more than 1.15750, and the target is 1.16000, 1.16300, and 1.16500-1.16700.

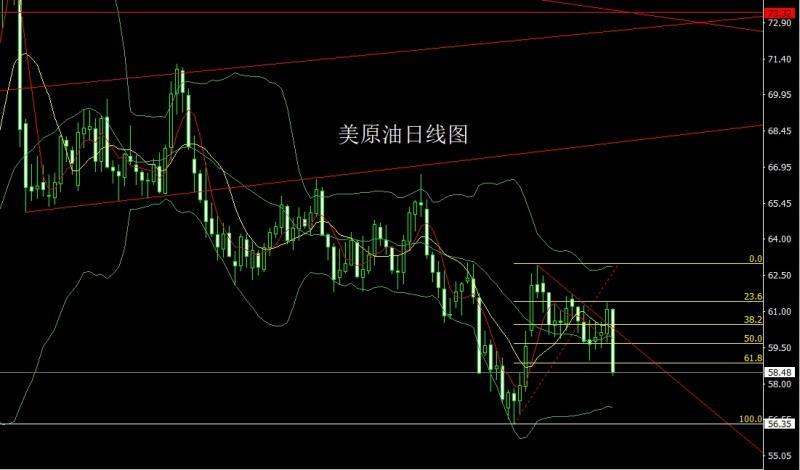

Yesterday, the U.S. crude oil market opened at 61.07 in early trading, and then the market rose slightly to reach the position of 61.14, and then fell back strongly. It accelerated downward after breaking the position the day before, and the daily low reached the position of 58.36 before consolidating. , the daily line finally closed at 58.48, and then the daily line closed with a saturated large negative line with a slight shadow line. After finishing in this form, the short stop loss is 60 at 59.5 today. The target is 58.3, 57.5, and 57.

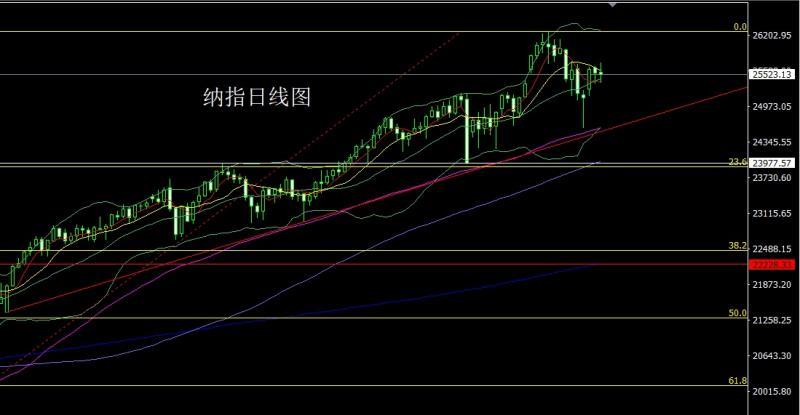

Yesterday, the Nasdaq opened at 25560.15 in early trading and then the market first rose to reach 25728.04 and then fell back strongly. The daily line reached the lowest position of 25376.64 and then consolidated. The daily line finally closed at 25523.13. After that, the daily line formed a Yin Cross star with equal lengths of upper and lower shadows. The state closed, and after this form ended, today 25670 short stop loss 25730, the target is 25500, 25350 and 25200.

Fundamentals, yesterday's fundamentals The US House of Representatives Majority Leader Scalise revealed that the House of Representatives will hold a full house vote on the bill to end the government shutdown at 8:00 Beijing time on the 13th. White House: October non-farm and inflation data may never be released. The four voting regional Fed presidents are not enthusiastic about another interest rate cut in December. Boston Fed President Collins: The Fed is likely to keep interest rates at current levels for some time. The labor market has not deteriorated, and it is necessary to ensure that inflation returns to 2% sustainably before cutting interest rates. Today's fundamentals mainly focus on the initial UK third-quarter GDP annual rate at 15:00 and the UK's September manufacturing output monthly rate. In addition, the US unseasonally adjusted CPI annual rate in October and the number of US initial jobless claims for the week to November 8 are yet to be announced.

In terms of operation, gold: the longs of 3325 and 3322 below and last weekThe long position of 3368-3370 and the long position of 3377 and 3385 and the long position of 3563 will be reduced and the stop loss will be followed up at 3750. If today it falls back to 4165 and long, conservatively stop the loss of 4162 and 4157. The target is 4200 and 4212, and if the position is broken, look at 1220 and 4232-4240.

Silver: The long position of 37.8 below and the long position of 38.8 follow up at 42. After reducing the long position of 50.9 yesterday, the stop loss is followed up at 51.2. Today, the long position is 52.3 and the stop loss is 52. The target is 53.2, 53.5 and 53.7, and the break position is 54 and 54.3.

Europe and the United States: Today 1 .15750 long stop loss 1.15550, target 1.16000 and 1.16300 and 1.16500-1.16700.

U.S. crude oil: 59.5 today, short stop loss 60. Target 58.3, 57.5 and 57.

Nasdaq: 25 today 670 short stop loss 25730, the target is 25500, 25350 and 25200.

The above content is all about "[XM Foreign Exchange]: The daily line has broken through the pressure, and gold and silver have still stepped back." It is carefully xmxyly.compiled and edited by the editor of XM Foreign Exchange. I hope it will be helpful to your trading! Thanks for the support!

Live in the present and don’t waste your present life by missing the past or looking forward to the future.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here