Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- The daily line is connected to the gate, and gold and silver are often asked for

- The money market has begun to stabilize, and this week it is closely watched Pow

- The euro/dollar fell below key support, will the bears take over in full?

- Avoid industry minefields

- Europe and the United States reach an agreement, gold bulls retreat and return t

market analysis

11.13 Gold surges, crude oil plummets, latest market trend analysis and today’s exclusive operation suggestions

Wonderful introduction:

One person’s happiness may be fake, but the happiness of a group of people can no longer distinguish between true and false. They squandered their youth to their heart's content, wishing they could burn it all away. Their posture was like a carnival before the end of the world.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Decision Analysis]: 11.13 gold surge, crude oil plunge, latest market trend analysis and today's exclusive operation suggestions." Hope this helps you! The original content is as follows:

Only those who help themselves can help others. What is difficult is not making profits every day, but how to deal with adversity. People's will will be shaken with the passage of time and the influence of objective things. In good times, you need to look within and know yourself. Only those who are wise can move to a higher point. In times of adversity, we need to look inward. Only by strengthening ourselves can we defeat the enemy! All external roots originate from our insides! We cannot change the uncertainty of objective things, but only by following the laws of objective things from beginning to end can we move forward. further! And the so-called laws are actually fait accompli in historical data! Human nature is difficult, so history will repeat itself! Just like spring, summer, autumn and winter, the cycle of four seasons, life, old age, illness and death, joy, anger, sorrow and joy! The same is true for the market! Because the essence of the market is the game of human nature!< /p>

Analysis of the latest gold market trends:

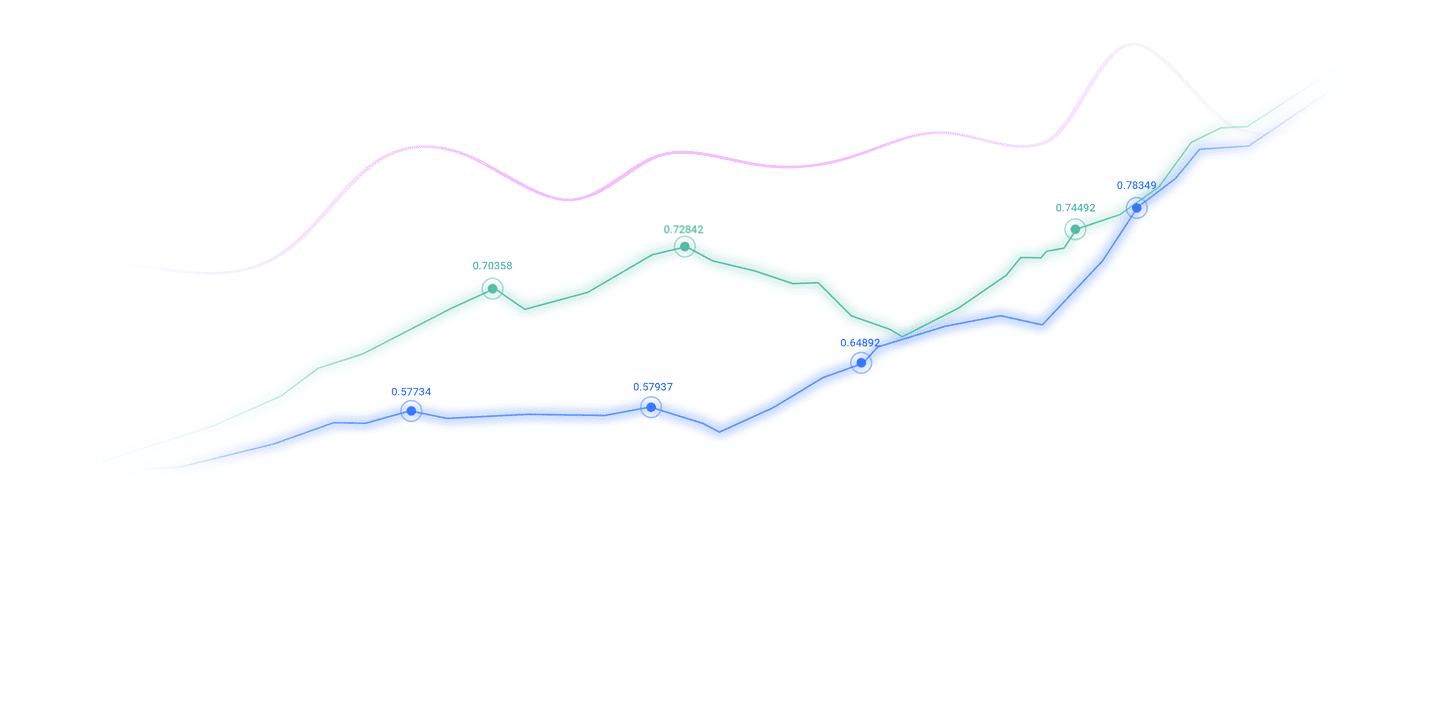

Analysis of gold news: In the US market on Wednesday (November 12), spot gold rose strongly and is currently trading around US$4,161 per ounce, holding on to the gains of the previous trading days. The price of gold rose 0.27% on Tuesday to close at US$4,126.62 per ounce. It hit an intraday high of US$4,148.91, a new high since October 23. The U.S. government shutdown is about to end, economic data is about to recover, and clear signals from hawks within the Federal Reserve turning dovish have jointly ignited the bullish flames in the gold market. The U.S. dollar index fluctuated on Wednesday and fell 0.14% to 99.48. It hit a new low in nearly two weeks to 99.29 during the session. The weak U.S. dollar provided a perfect assist for gold. Data show that holdings of SPDR, the world's largest gold ETF, increased by 4.3 tons to 4,046.36 tons on Tuesday, a new high since October 25.

Gold technical analysis: Gold first rose above the 4116 line in early trading yesterday, then fell back to the 4149 line as high as the Asian session, and rebounded at the end of the U.S. trading session as low as the 4096 line. The daily line finally closed at the 4126 line, closing in the shape of a spindle with upper and lower shadows of equal length. Gold is currently bullish. The main idea is to focus on the breakthrough of the 4100 to 4160 range during the Asian market. If there is a breakthrough above, there will be at least hundreds of points of space. It is better to operate directly and layout. If it falls back to support, there are several more important points to pay attention to, which are yesterday's US low of 4097 and the two rising nodes 4080 and 4060. Above, focus on the resistance near yesterday's high of 4149. If this position cannot be effectively broken, it will temporarily fluctuate. Once I stand firm, I personally tend to look at the 4160-4190 line and then backhand again. The 1 hour line still has momentum to rise. It fell slightly below 4100 last night and then quickly reversed, indicating that the short-term 4100 support is still effective. Gold continues to go long on dips after falling back to 4100. On the whole, today's short-term operation of gold, He Bosheng suggests to focus on the low and long rebound, supplemented by the rebound from the high altitude. The top short-term focus will be on the first-line resistance of 4180-4200, and the bottom short-term will focus on the first-line support of 4130-4110.

Analysis of the latest crude oil market trend:

Analysis of crude oil news: During the Asian session on Wednesday, Brent crude oil was trading at US$65.03/barrel, and U.S. WTI crude oil was trading at US$60.92/barrel, approaching the intensive pressure range after rising for two consecutive days. Market analysts believe that the latest U.S. sanctions on Russia’s energy sector have gradually penetrated into the export chain, causing some buyers to reassess import risks. According to market surveys, five major Indian refineries have not yet placed orders for the purchase of Russian crude oil in December, showing signs of restrictions on export flows. From a trend perspective, the sustainability of rising oil prices still depends on the intensity of sanctions and the reaction speed of the buyer's market. Although the current cautious attitude of Asian countries has put pressure on the supply side, global crude oil inventory levels and the production adjustment ability of non-Russian oil-producing countries are still balancing factors. If restrictions on Russian exports continue in the next few weeks, oil prices are expected to continue to rebound, and we need to pay attention to changes in inventory data this week.

Crude oil technical analysis: From the daily chart level, from the local level, the current oscillation rhythm of crude oil is a minor shock, and the previous main trend is three solid positive lines from the low of 55.96. Judging from the primary and secondary rhythms, there is still room for a rebound in the trend. The MACD indicator is below the zero axis, and bulls still need to further accumulate momentum. It is expected that after the mid-term trend of crude oil is supported by the backtest low, it is expected to form a rebound upward. The short-term (1H) trend of crude oil broke through the upper edge of the narrow range and showed an upward rhythm. Oil prices are about to hit the strong resistance position of 61.50 within the day. The moving average system is arranged in a long position, and the short-term objective trend is upward. The MACD indicator crosses the zero axis and is running at a high level, with bulls performing strongly. It is expected that there is a high probability that the trend of crude oil will break through the resistance and continue to rise during the day. Taken together, He Bosheng recommends rebounding in terms of crude oil operation today.The top short-term focus is on the 60.5-61.5 first-line resistance, and the bottom short-term focus is on the 58.0-57.0 first-line support.

This article is exclusively planned by He Bosheng, a gold and crude oil analyst. Due to the delay of network push, the above content is personal advice. Due to the timeliness of online publishing, the suggestions in this article are for learning reference only. You should operate at your own risk. Regardless of whether the views and strategies of the article agree with others, you can xmxyly.come to me to discuss and learn together! Nothing is difficult in the world, as long as there are people who are willing. Investment itself carries risks. I remind everyone to look for authoritative platforms and powerful teachers. Fund safety xmxyly.comes first, secondly consider operational risks, and finally how to make profits.

The above content is all about "[XM Foreign Exchange Decision Analysis]: 11.13 gold surge, crude oil plunge, latest market trend analysis and today's exclusive operation suggestions". It is carefully xmxyly.compiled and edited by the XM foreign exchange editor. I hope it will be helpful to your trading! Thanks for the support!

After doing something, there will always be experiences and lessons learned. In order to facilitate future work, the experience and lessons of past work must be analyzed, researched, summarized, concentrated, and understood at a theoretical level.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here