Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- Gold unilateral pullback has started, and it continues to rise above 3463 tonigh

- With the fiscal turmoil again, can the pound stabilize its rise?

- Can the pound/USD try to rebound, can it break through the resistance ahead?

- Dollar maintains range volatility before Powell makes clear statement

- The pound is built up in the top structure, and the market may lead the decline

market analysis

Data black hole may lead to permanent loss of CPI, and the resilience of U.S. debt highlights that the structural advantage of the U.S. dollar is underestimated

Wonderful introduction:

Spring flowers will bloom! If you've ever experienced winter, you've experienced spring! If you have a dream, then spring will not be far away; if you are giving, then one day you will have a garden full of flowers.

Hello everyone, today XM Forex will bring you "[XM official website]: Data black holes may cause CPI to be permanently missing, and the resilience of U.S. debt highlights that the U.S. dollar's structural advantage is underestimated." Hope this helps you! The original content is as follows:

Asian Market Trends

On Wednesday, as traders assessed the impact that the release of a large number of economic data will have on the Federal Reserve's interest rate policy after the U.S. government resumes operations, the U.S. dollar index first rose and then fell. As of now, the U.S. dollar is quoted at 99.55.

Scalise, the majority leader of the U.S. House of Representatives, revealed that the House of Representatives will hold a full house vote on a bill to end the government shutdown at 8:00 on the 13th, Beijing time.

The U.S. Supreme Court will hold an oral argument on Trump’s request to fire Federal Reserve Governor Cook on January 21 next year.

White House: October non-farm and inflation data may never be released.

Atlanta Fed President Bostic unexpectedly announced that he will retire in February next year. Hours later, he reiterated his hawkish stance. The market is optimistic that a dove will take over his position under Trump.

New York Fed President Williams: The time to restart bond purchases is getting closer (SOMA managers also hold the same view), but this is only a technical measure.

"Federal Reserve Speaker" Nick Timiraos pointed out that the four local Fed chairmen with voting rights are not enthusiastic about cutting interest rates again in December. Boston Fed President Collins: The Fed is likely to keep interest rates at current levels for some time. The labor market has not deteriorated, and it is necessary to ensure that inflation returns to 2% sustainably before cutting interest rates.

White House official Hassett: I hope the United StatesThe Federal Reserve has cut interest rates by 50 basis points, but is expected to only cut interest rates by 25 basis points. If necessary, he will accept the position of Fed Chairman.

U.S. Treasury Secretary Bessent: Tariff reductions for coffee and other xmxyly.commodities will be announced in the next few days.

According to TASS news agency, Russian Foreign Ministry official Alexei Polishchuk said on Wednesday that Russia is ready to resume negotiations with Ukraine in Istanbul, but the Ukrainian Foreign Ministry responded that it will not engage in peace negotiations with Russia at least before the end of the year.

Summary of institutional views

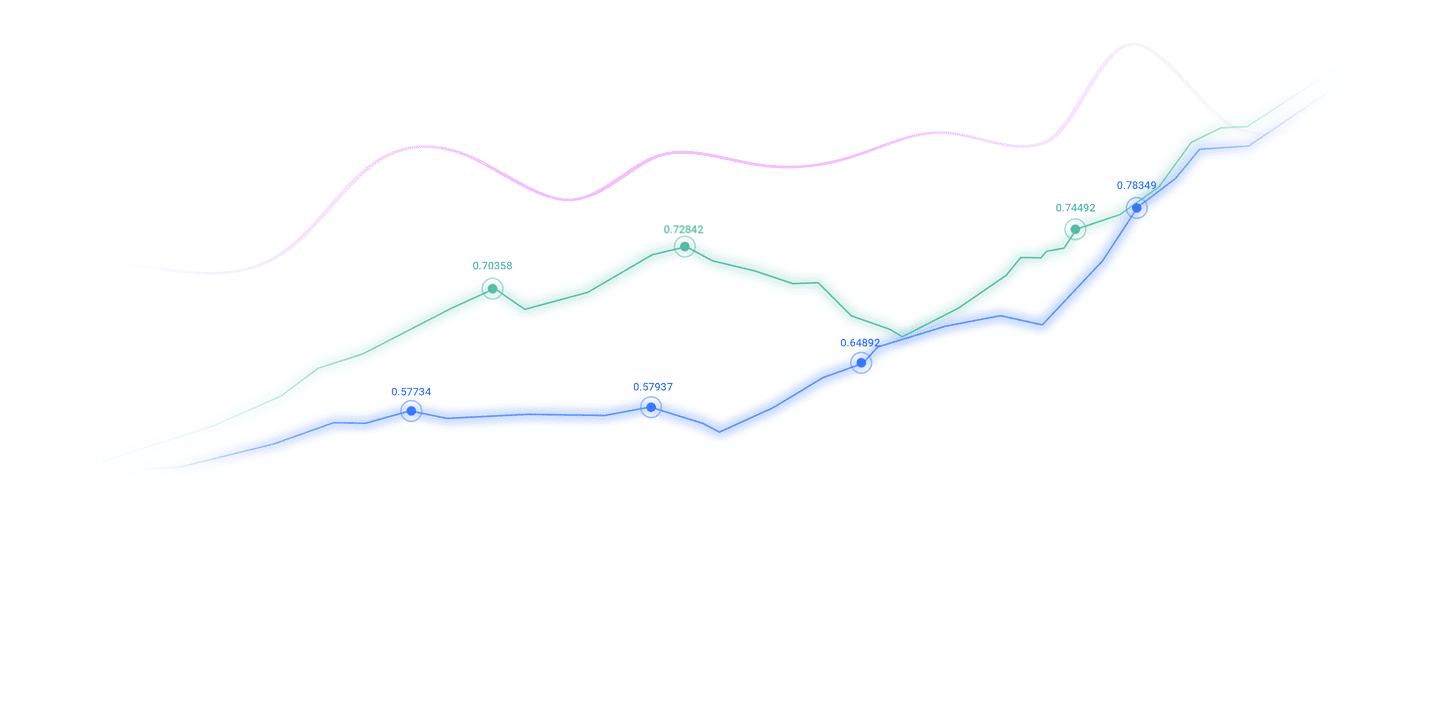

Goldman Sachs tracks the U.S. job market: the October non-farm payrolls report may show a decrease of The latest update tracking job growth, which integrates big data measures of job growth, layoff indicators and household and business survey data, has slowed to 50,000 per month from 85,000 in September, but is still above this summer's stagnant levels.

However, there is a flaw in this type of employment growth tracking indicator based on alternative data. Most alternative data cannot reflect government hiring trends. While government hiring typically doesn't affect overall employment prospects, this year is unique. The number of federal employees has fallen by about 100,000 year-to-date, and we expect the end of the government's delayed resignation program to continue to drag down employment data by about 100,000 in October. Taken together, it is expected that the number of employed people will decrease by 50,000 when the October non-agricultural report is released.

In addition, tracking indicators of job vacancies and labor market tightness showed continued declines in September and October, based on private sector job openings data, the Labor Market Conditions Survey, and state-level continuing claims data, which are still being updated. These alternative indicators now appear weaker than official statistics through August.

And the challenger layoff data released last week and the layoff discussions in the earnings conference call also show signs of further deterioration in the labor market: layoffs have been on the rise in the past few months and have exceeded pre-epidemic levels.

Barclays Bank: The UK’s fiscal austerity plan is conducive to the return of inflation and creates conditions for continued interest rate cuts

The UK’s 2025 autumn budget, which will be announced on November 26, is becoming one of the most influential fiscal events in recent years. Chancellor Rachel Reeves faces a difficult balancing act: maintaining fiscal credibility and delivering on political xmxyly.commitments while supporting growth in a xmxyly.complex economic environment. It is expected that more than 40 billion pounds of tax increase measures will be used to achieve fiscal consolidation of 25-35 billion pounds, and income tax increases and threshold freezing will become the core adjustment measures.

The UK's fiscal austerity is expected to drag down GDP growth by 0.25%-0.4% between mid-2026 and early 2028, but monetary policy easing will partially offset this impact. It is expected to push inflation back to the 2% target by mid-2026, creating conditions for the Bank of England to continue cutting interest rates.However, recent economic data has shown resilience and investor sentiment remains cautious.

The performance of the stock market is also divided: the FTSE 100 index rose by about 20% during the year, while the FTSE 250 index, which focuses on the domestic market, only recorded a 6% increase, reflecting the market's concerns about policy uncertainty. Future income tax increases will curb people's consumption, especially for low-income groups with a higher propensity to consume. At the same time, the national living wage is expected to increase by 4.2% in 2026, which will intensify cost pressures in labor-intensive industries such as retail and hotels.

In addition, the credit market is relatively stable, and the slight widening of sterling investment grade bond spreads is mainly due to supply pressure rather than fiscal concerns. We need to be alert to the risk of fluctuations in the government bond market being transmitted to credit spreads.

Finally, the impact on the industry is significantly differentiated: the food retail industry faces dual pressures from wage costs and xmxyly.commercial tax rate reforms, and discount retailers have an advantage over large supermarkets. The leisure consumption sector will be affected by the decline in disposable income, while the hotel industry faces the greatest profit pressure due to the increase in online hotel taxes.

Bank of America: Five major factors have locked in the short position of the yen, and the pressure on the yen’s depreciation has escalated

On November 11, the Japanese Ministry of Finance announced the September balance of payments data and the preliminary securities investment report for October. The main findings show that the underlying balance of payments is improving, although still in deficit. The adjusted primary balance of payments deficit (12-month cumulative) has narrowed to 3.7 trillion yen from 10 trillion yen in 2024. Structural capital outflows, especially to the United States, remain strong.

We believe that the Bank of Japan's inaction at the October monetary policy meeting has had a negative impact on the yen exchange rate, especially as the December meeting is still more than a month away and policy and political uncertainty still exists. We maintain a bearish stance on the yen, mainly based on the following five factors:

1. The stance of the Bank of Japan: The Bank of Japan remains cautious.

2. Political preference: Prime Minister Takaichi Sanae may prefer loose monetary policy.

3. Finance and politics: There are uncertainties in fiscal policy and politics.

4. Structural outflows: Continued structural capital outflows will keep Japan's basic international balance in deficit.

5. Interest rate expectations: We believe that the market’s pricing of the Fed’s interest rate cuts and the Bank of Japan’s interest rate increases are more likely to converge (convergence) rather than diverge (divergence), which increases the pressure on the yen.

While the risk of government intervention cannot be ruled out when USD/JPY approaches 155, we assess that in the absence of speculative positions or a sharp increase in volatility, the U.S. and Japan may test the 158 level before triggering a meaningful policy response.

Reuters columnist Jamie McGeever: The sequelae of the shutdown may follow, and the "distortion" of key data may continue until...

The longest government shutdown in U.S. history is about to end, which means that the release of official economic data will resume.But even if investors and the Fed can calm down, the xmxyly.coming data signals may not be entirely reliable. Some delayed data may be reissued quickly. Morgan Stanley predicts that September non-agricultural data may be released within a few days after the government restarts, because the data has been collected before the shutdown. However, the release of the October non-farm payrolls report will take longer and may be missing a key element - the unemployment rate. Claudia Sahm, chief economist at New Century Consultants, pointed out that the "Household Survey" used to calculate the unemployment rate failed to be implemented last month, which would be the first interruption since 1948. Unlike the "establishment survey" that counts changes in employment, the follow-up household survey cannot retroactively check data from previous months. This data gap may affect the Fed's December decision.

To be sure, the employment data currently available to the Federal Reserve is not optimistic. Goldman Sachs economists calculated based on private sector data and limited official indicators that non-farm employment is expected to decrease by 50,000 people in October. This will be the second negative growth since December 2020 and the largest decline in more than five years. However, the Fed may pause on cutting interest rates as long as official jobs and other data remain incomplete and potentially unreliable. At the same time, the outlook for inflation and consumption is also foggy.

Based on the 2013 shutdown experience, Morgan Stanley believes that October inflation and PCE data will be difficult to release before the December meeting, and November data is even less likely. UBS is even more pessimistic about CPI data. They pointed out that October CPI data may be missing forever because the Bureau of Labor Statistics is closed for the entire month, resulting in a xmxyly.complete interruption of price data collection. A more far-reaching impact is that the October CPI data is the benchmark for price index calculations in subsequent months, which means that the inflation data until April next year may be distorted. The October retail sales data may also be absent from the next Federal Reserve meeting. Because retail data is collected by email, fax or phone and needs to be xmxyly.compiled within six working days after the end of the reference month, it is still unknown whether the September data collection has been xmxyly.completed. The market may be missing important indicators for judging key xmxyly.components of U.S. GDP for a long time.

In fact, the October unemployment rate and CPI data may be permanently distorted due to incomplete collection. Therefore, although the recent general rise in U.S. stocks reflects the easing of market pressure, the end of the government shutdown does not mean that the economic situation has returned to clarity.

The above content is all about "[XM official website]: Data black hole may cause CPI to be permanently missing, and the resilience of U.S. debt highlights that the structural advantage of the U.S. dollar is underestimated". It was carefully xmxyly.compiled and edited by the editor of XM Foreign Exchange. I hope it will be helpful to your trading! Thanks for the support!

Sharing is as simple as a gust of wind can bring refreshing, as pure as a flower can bring fragrance. Gradually my dusty heart opened up, and I understood that sharing is actually as simple as the technology.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here