Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- Trump's tariffs suddenly became a big deal! Waiting for Powell Jackson Hall to s

- The pregnancy line is sorted for data, and gold and silver are back to make shor

- In the tug-of-war before the pound 1.35 mark, who will win the bulls and bears?

- Guide to short-term operation of major currencies

- The dollar index continues to fall, and Fed Daly predicts two interest rate cuts

market news

Driven by expectations of a rate cut by the Federal Reserve, the U.S. dollar index remains within a narrow range in the short term.

Wonderful introduction:

Let me worry about the endless thoughts, tossing and turning, looking at the moon. The full moon hangs high, scattering bright lights all over the ground. xmxyly.come to think of it, the bright moon will be ruthless, thousands of years of wind and frost will be gone, and passion will grow old easily. If you have love, you should grow old with the wind. Knowing that the moon is ruthless, why do you always place your love on the bright moon?

Hello everyone, today XM Forex will bring you "[XM Foreign Exchange Decision Analysis]: Driven by expectations of the Federal Reserve's interest rate cut, the U.S. dollar index will maintain a narrow range in the short term." Hope this helps you! The original content is as follows:

The U.S. dollar index remained within a narrow range in Asian trading on Thursday, and the U.S. dollar fell slightly against the euro on Wednesday as traders assessed the potential impact on the Federal Reserve policy of a large amount of economic data to be released after the U.S. government ends its shutdown. Meanwhile, the yen fell to its lowest level in nine months against the dollar on concerns that Japan's new government could pressure the central bank to delay raising interest rates.

Analysis of major currency trends

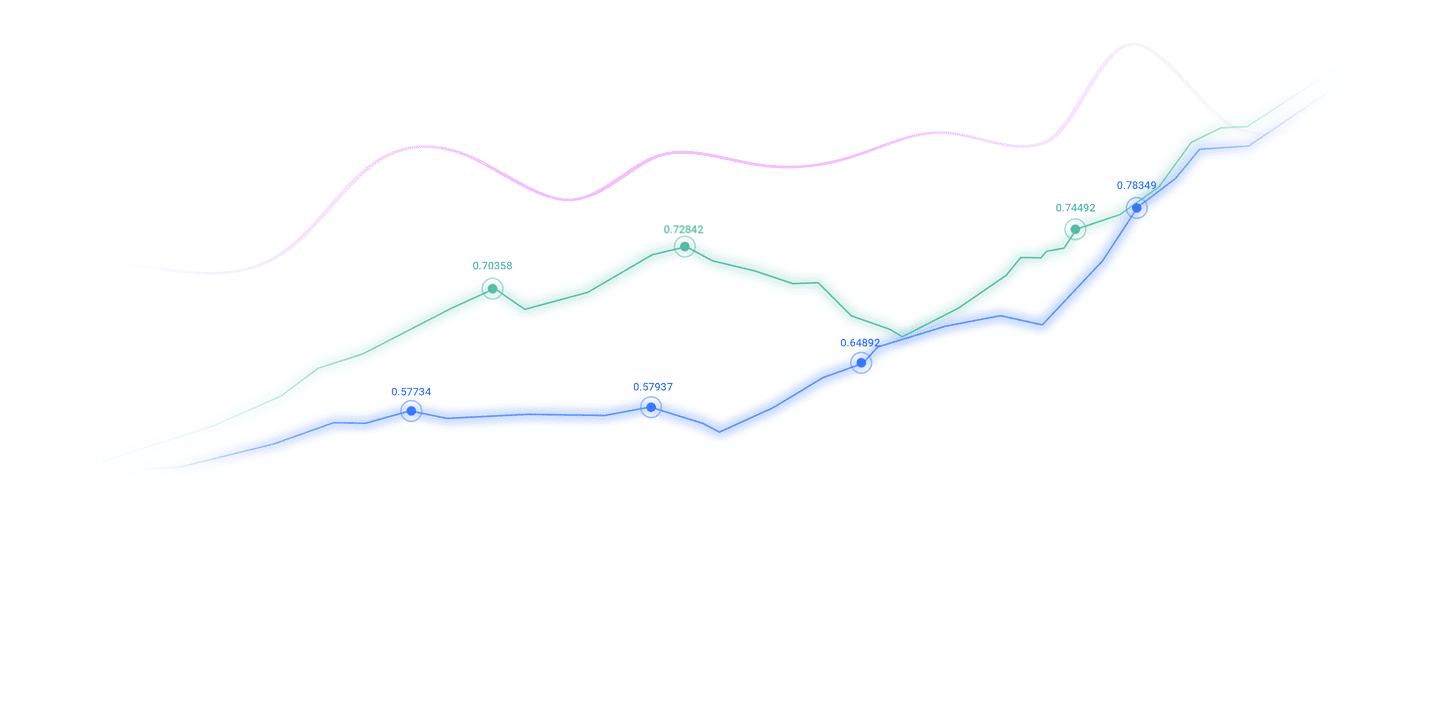

U.S. dollar: As of press time, the U.S. dollar index is hovering around 99.50. The U.S. dollar has been under significant pressure recently. The core pressure stems from the weakness of the U.S. labor market and rising expectations of easing by the Federal Reserve. The continued shutdown of the U.S. government has led to the stagnant release of key economic data, leaving the market in a data vacuum. Investors are forced to turn to the statements of Federal Reserve officials for guidance. This week, the U.S. dollar index continued the correction trend since last week's high, providing phased support for the euro against the U.S. dollar. Technically, the 50-period moving average is trending flat, while the 200-period moving average still provides support near 99.00. If it can continue to break through 99.80, it may push the index to test the 100.35-100.65 range, which is consistent with the 23.6% Fibonacci retracement level. Relative Strength Index (RSI) readings around 45 indicate neutral momentum, but improving technical structure points to a gradual recovery.

UK employment data showed unemployment at 5% and wage growth slowing, raising the probability of a Bank of England rate cut in December to 90%. Technically, the technical picture for GBP/USD remains biased to the downside, although sellers will need to drag the pair below 1.3100 to challenge the latest cycle low of 1.3010 set on November 5. A break below these two levels could expose the April 7 low of 1.2707. Conversely, a daily close above 1.3100 could see the pair remain subdued around 1.3100-1.3150 in the absence of catalysts due to the limited UK economic calendar and the US government shutdown.

1. Most local Fed voting xmxyly.committees are not enthusiastic about cutting interest rates in December

Federal Reserve officials have recently spoken out intensively to discuss monetary policy. "Fed spokesperson" Nick Timiraos said that there are currently four local Fed presidents with voting rights (Boston Fed Collins, St. Louis Fed Musallem, Chicago Fed Goolsby, and Kansas Fed Schmid, who voted against the October interest rate cut resolution) and have not actively promoted another interest rate cut in December. Jin 10’s Note: The Federal Reserve rotates four regional Feds as FOMC voting xmxyly.committees every year. Starting next year, the above four officials will lose their voting rights on the FOMC. The New York Fed has a special status and has permanent voting rights.

2. Fed Collins: It may be appropriate to keep interest rates unchanged for a period of time

This year's FOMC voting xmxyly.committee and Boston Fed President Collins said on Wednesday that she believed the threshold for further interest rate cuts in the short term was "relatively high" due to concerns that inflation remains high. Collins voted for a rate cut last month. “Unless there are signs of significant deterioration in the labor market, I would be cautious about easing policy further, especially with limited inflation data available to us due to the government shutdown... at a time of high uncertaintyIn this environment, in order to balance inflation and employment risks, it may be appropriate to maintain policy rates at current levels for a period of time. Her speech highlighted deep divisions within the Fed. Since the last rate cut, several voting and non-voting Fed officials, including Collins, have signaled increasing caution about cutting interest rates. Collins believes that short-term borrowing costs are currently in "mildly tight" territory, while financial conditions generally remain a tailwind for economic growth. The labor market has indeed slowed, but downside risks have not intensified since the summer.

3. The Swedish krona should remain strong because it will benefit from fiscal stimulus in Sweden and the euro zone, Francesco Pesole, an analyst at ING, said in a webinar. The Swedish krona generally has a higher positive correlation with euro zone sentiment than the euro itself, he said. Fiscal stimulus will be transmitted to the euro area economy in 2026. In Sweden, the fiscal stimulus package in 2026 includes tax cuts, and ING believes that there may be more fiscal expansion xmxyly.commitments before the September election. ING expects the Swedish economy to expand by 1.2% next year, with room to exceed expectations. The bank expects the euro to SEK to fall to 10.50 by the fourth quarter of 2026. 4. ECB Governing Council: The xmxyly.combination of fiscal stimulus and economic recovery has tilted inflation risks in the euro area to the upside

According to ECB executive member Schnabel, inflation risks in the euro area are tilted to the upside as the economy is gathering momentum and governments are starting to invest huge sums in military and infrastructure. Schnabel said: “My narrative is a recovering economy, the output gap is narrowing, and there is expected to be significant fiscal stimulus, which will stimulate the economy. Schnabel is currently seen as the most hawkish member of the management xmxyly.committee. "This leads me to conclude that if there is any risk, it is that the risk is tilted to the upside," she added. The German official said she believed interest rates were at an "absolutely" appropriate level and that policymakers must remain vigilant against rising food costs that are "still quite strong" and the "stickiness" of service sector inflation. Schnabel said that overall, she was not worried about small deviations from 2% and downplayed potential downside risks.

5. Still fearless despite rumors of tax hikes, UK inflation-linked bonds attracted record bids

According to foreign media reports, data showed that the UK The sale of inflation-linked bonds attracted record orders, easing debt sustainability concerns ahead of this month's budget. Investors subscribed to more than 69 billion pounds of bids for 4.25 billion pounds of British debt syndicates on Wednesday. The sale is the last such bond sale before the budget on November 26. She is under pressure to increase fiscal space, with recent reports suggesting that she will raise taxes at the best level in almost two years.The performance, which has attracted investors including Aberdeen, Fidelity International and JPMorgan Asset Management, has given her some breathing room.

Institutional Views

1. ING: Fiscal austerity will push up expectations of interest rate cuts and the pound still has room to fall

Francesco Pesole, an analyst at ING, said in a webinar that although fiscal risks have been digested before the budget on November 26, there is still room for the pound to weaken further. ING estimates that the fiscal tightening in the budget will reach 0.5% to 1% of GDP. Pesole said this could encourage markets to price in more rate cuts from the Bank of England, which would be negative for the pound. He also said growth expectations may also be revised downwards. Although GBP is currently selling expensively, we do not believe it will be attractive from a fundamental perspective over the next year.

2. ING: The dollar may fall due to the Supreme Court ruling

Chris Turner, an analyst at ING, said in a webinar that if the Supreme Court rules that there are questions about the legality of Trump's use of emergency powers to impose xmxyly.comprehensive tariffs, the dollar may fall. He believes that this decline will be realized mainly through the potential impact on the US bond market. He said the loss of tariff revenue could lead to a sell-off in long-dated Treasuries. The suspension of tariffs will also benefit the rest of the world, supporting other currencies. However, he added that Trump may find other ways to impose tariffs.

3. xmxyly.commerzbank: Increased bond issuance in the United States and Europe will push up risk premiums

Analysts at xmxyly.commerzbank said in a report that increased bond issuance in the United States and Europe will prompt investors to demand higher risk premiums, thereby pushing up government bond yields and steepening the yield curve. They believe a steeper yield curve is expected on both sides of the Atlantic. However, with expectations for further interest rate cuts from the Federal Reserve, yields are unlikely to move significantly higher. xmxyly.commerzbank predicts that by the end of 2026, the German 10-year Treasury bond yield will rise to 3%, and the U.S. 10-year Treasury bond yield will hit 4.5%. According to data from Tradeweb, the 10-year German government bond yield rose 2 basis points to 2.675%, while the 10-year U.S. Treasury bond yield fell 2.3 basis points to 4.088%.

The above content is all about "[XM Foreign Exchange Decision Analysis]: Driven by expectations of the Federal Reserve's interest rate cut, the U.S. dollar index maintains a narrow range of fluctuations in the short term". It is carefully xmxyly.compiled and edited by the editor of XM Foreign Exchange. I hope it will be helpful to your trading! Thanks for the support!

Due to the author's limited ability and time constraints, some contents in the article still need to be discussed and studied in depth. Therefore, in the future, the author will conduct extended research and discussion on the following issues:

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here