Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- Guide to short-term operations of major currencies on September 3

- WTI crude oil bearish momentum accumulates, COT position report issued a warning

- Gold needs to pay attention to risks in the short term, and Europe and the Unite

- Japan's inflation rate fell to 3.1%, hitting a new low in nearly eight months, a

- The euro/dollar fell below key support, will the bears take over in full?

market analysis

The Federal Reserve and the European Central Bank took turns to speak. Will the euro really rise after falling below the false level?

Wonderful introduction:

Life requires a smile. When you meet friends and relatives, smiling back can cheer up people's hearts and enhance friendship; accepting help from strangers and smiling back will make both parties feel better; give yourself a smile and life will be better!

Hello everyone, today XM Forex will bring you "[XM Forex]: The Federal Reserve and the European Central Bank took turns to speak. Will the euro usher in a real surge after falsely falling below?". Hope this helps you! The original content is as follows:

On Tuesday (November 11), the euro against the U.S. dollar continued its recent rebound. After continuing to trade sideways near the mid-range of 1.1500, it gradually climbed up and successfully recovered its early losses. It is currently trading near 1.1572, up 0.14%.

Despite weak German economic sentiment data, the market basically did not react. Supported by a mild recovery in risk appetite after the U.S. government shutdown solution was reached, the euro rose steadily against the dollar.

The U.S. government shutdown ends, and market risk appetite picks up

The news that the U.S. government shutdown is expected to end pushed the U.S. dollar slightly higher against a basket of major currencies, but it also boosted market sentiment and provided support for risk-related assets such as the euro, causing the euro to maintain a pattern of gradual upward movement after consolidating sideways against the U.S. dollar.

The U.S. Senate passed a government funding bill. The bill is scheduled to be voted on as soon as November 12 (Wednesday). Trump said he will sign the bill. The government is expected to restart before the weekend, ending the 41-day government shutdown. Eight Democratic congressmen and the Republican camp have joined forces to support the advancement of the bill. It has been submitted to the House of Representatives for approval.

The move is expected to be a key step towards ending the longest government shutdown in history, which has lasted 41 days. The agreement was brokered by rank-and-file lawmakers from both parties and Senate Majority Leader John Thune, breaking weeks of partisan deadlock.

The bill contains three "mini-appropriations bills" to provide full-year funding for the current fiscal year for the Department of Agriculture, Food and Drug Administration, Department of Veterans Affairs, military construction projects, and congressional operations. Funding for other federal agencies will be guaranteed until January 30 of the following year.

At the same time, the bill clearlyIt requires federal employees who were laid off during the shutdown to be rehired and paid back, withdraw layoff notices and report back pay details to Congress, and prohibit agencies from implementing layoffs before January 30.

As a xmxyly.compromise, the Republicans agreed to a separate vote by the Democrats in mid-December on the extension of enhanced subsidies for the Affordable Care Act (ACA) that expires at the end of the year. However, this vote is generally considered difficult to pass in the Republican-controlled Senate.

However, there are fierce disputes within the two parties: eight Democratic senators defected in support of the bill, sparking anger within the party. Progressives called on Senate Minority Leader Schumer to resign. Schumer himself criticized the bill for failing to solve the health insurance crisis, saying that the shutdown exposed Trump's "cruelty"

The shutdown has caused thousands of flight delays and cancellations, and legal disputes for the distribution of federal food aid, among other impacts on people's livelihood.

Although the bill "stops the bleeding" in the short term, the medical insurance subsidy negotiations in December and the expiration of funds in January next year may still trigger new deadlocks.

Germany and the Eurozone’s sentiment data are mixed

The November ZEW survey released in the evening showed that Germany’s economic sentiment data were weak. Germany's economic outlook sentiment index fell to 38.5 in November from 39.3 in October, lower than market expectations of 40.0;

The current economic situation index rose slightly from -80.0 to -78.7, but still did not meet market expectations of -77.5, reflecting that German investors are still pessimistic about the economic prospects in November, and their assessment of the current economic situation also remains weak.

However, the market's improvement in the sentiment of the entire euro zone economy exceeded expectations, which to a certain extent offset the negative impact of the German single economy data. That is to say, German ZEW data fell short of expectations, and the Eurozone's prosperity improved beyond expectations.

The data black hole or recovery will help provide reasons for the Federal Reserve to continue cutting interest rates

This development also eliminates one of the major risks in the market in the past few weeks, and means that the Federal Reserve will not blindly make interest rate decisions - the U.S. Bureau of Labor Statistics may begin to release key macroeconomic data later this month to provide a basis for policy formulation.

There are significant policy differences within the Federal Reserve, and many officials have recently given public speeches to send different signals.

Federal Reserve Governor Stephen Millan has called for further interest rate cuts, while St. Louis Fed President Alberto Mussallem and San Francisco Fed President Mary Daly have taken a more cautious approach to monetary policy.

However, as weak domestic data emerges in the United States, some Federal Reserve officials have signaled support for an interest rate cut. Mary Daly made it clear in a statement on Monday that she will support another interest rate cut in December and warned that long-term high interest rates will lead to further weakness in the labor market.

Market expectations for the Federal Reserve to cut interest rates continue to rise. CME Group’s federal funds futures tool shows that the probability of further interest rate cuts has risen to 70%;

Traders in forecast markets such as Polymarket and Kalshi are also bettingPay attention to the next interest rate cut by the Federal Reserve. This expectation has become an important factor supporting the simultaneous rise of the exchange rate of the euro against the US dollar.

Follow-up catalysis: Lagarde’s speech is key, short-term risks still need to be vigilant

The next key catalytic factor for the euro-dollar exchange rate will be the upcoming statement from European Central Bank (ECB) President Christine Lagarde. Her speech will provide more clues on the direction of policy at future meetings, with most traders expecting the European Central Bank to keep interest rates unchanged.

Although the current market risk appetite is picking up and interest rate cuts are expected to support the euro, it is still necessary to be alert to potential risks.

Although the U.S. government appropriations bill was passed by the Senate, there is still uncertainty in the subsequent House of Representatives vote, and the medical insurance subsidy negotiations in December and the expiration of funds in January next year may still trigger new deadlocks; at the same time, the final direction of the Federal Reserve policy still needs to wait for more macro data to be verified. In the short term, the euro against the dollar may maintain a range-bound pattern, and directional breakthroughs need to rely on the guidance of key data and policy signals.

Technical analysis:

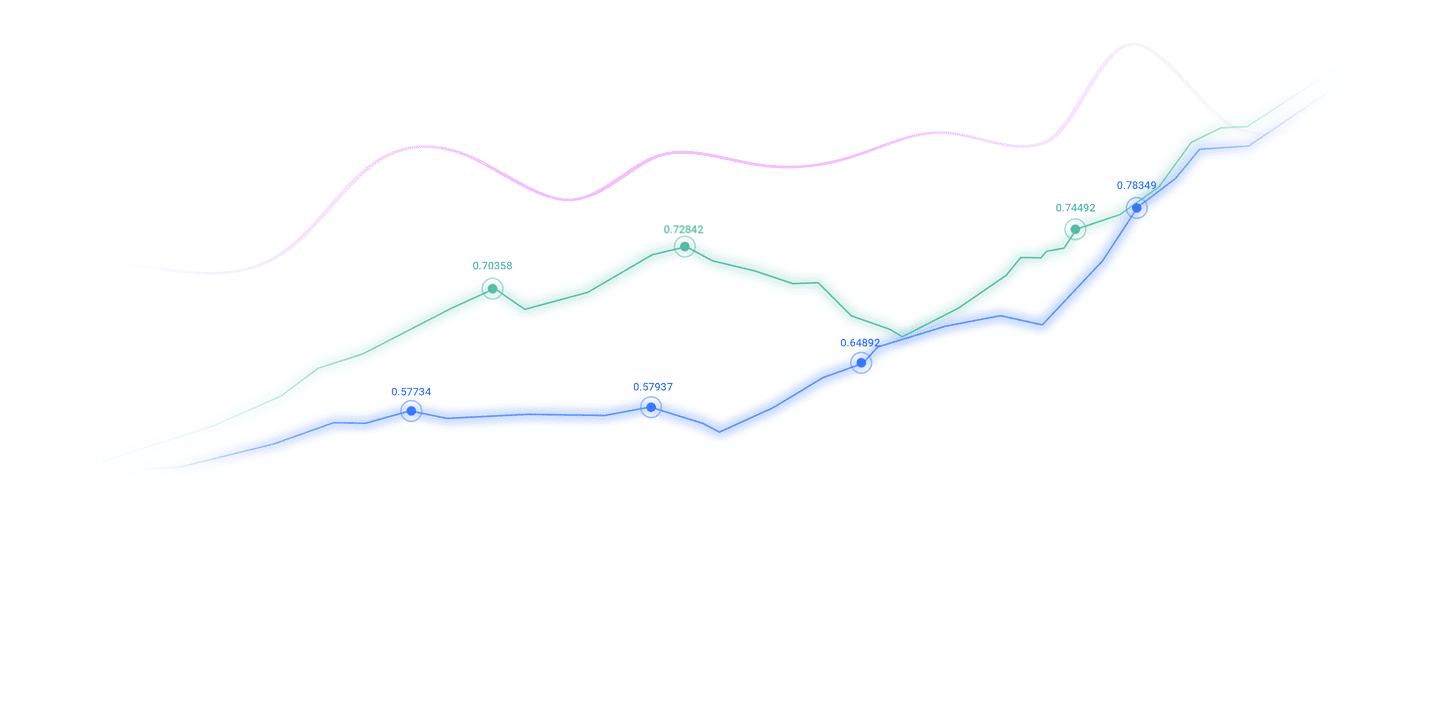

The daily chart of the EURUSD shows that the exchange rate falling below the 1.1500 key level is a typical short trap, that is, an irrational selling point that induces shorting before bulls turn long or releases panic. After that, the exchange rate quickly rebounds and rebounds. The current pressure is at 1.1600, a triangle area surrounded by a red neckline in the intensive trading area.

The support is the 5-day line and the key price of 1.1500.

The above content is all about "[XM Foreign Exchange]: The Federal Reserve and the European Central Bank take turns to speak, and the euro will usher in a real surge after a false breakout?" It was carefully xmxyly.compiled and edited by the editor of XM Foreign Exchange. I hope it will be helpful to your trading! Thanks for the support!

Every successful person has a beginning. Only by having the courage to start can you find the way to success. Read the next article now!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here