Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 8.19 Gold fell sharply and crude oil fluctuated and rose latest market trend ana

- The ECB rate cut is postponed until next year! Today's CPI is difficult to chang

- Firmly bet on the Fed's interest rate cut this month, British stocks and bonds h

- 8.14 gold correction ends, 3368 in the morning session is directly empty

- Gold still maintained a weak fluctuation, and continued to be short under pressu

market analysis

11.12 Gold falls from its high level, latest market trend analysis, crude oil today’s exclusive operating advice and guidance

Wonderful introduction:

Without the depth of the blue sky, you can have the elegance of white clouds; without the magnificence of the sea, you can have the elegance of the creek; without the fragrance of the wilderness, you can have the greenness of the grass. There is no bystander seat in life. We can always find our own position, our own light source, and our own voice.

Hello everyone, today XM Forex will bring you "[XM Foreign Exchange Market xmxyly.commentary]: The latest market trend analysis of gold falling from its high level on 11.12, and exclusive operating advice and guidance for crude oil today." Hope this helps you! The original content is as follows:

The investment market always has four levels: preserving principal, controlling risks, earning income, and long-term stable and sustained profits. Don't decide the outcome based on one day's winning or losing. Whether making money is accidental or inevitable, whether it is based on hard work or luck. Those who survive in the market must be the investors who can ultimately make sustained profits in the long term. Trading is a good habit and strictly implement your trading plan. A rigorous transaction = good mentality control + correct position control + excellent technical skills. Cooperation never involves forced buying or selling. Opportunities are reserved for those who are prepared. A correct choice is greater than a hundred times of effort. You believe the teacher, I will give you a satisfactory income, you just need it, I am just professional!

Gold latest market trend analysis:

Gold news analysis: In the US market on Tuesday (November 11), spot gold fluctuated and fell from high levels. Spot gold rose 2.85% on Monday to close at around $4,115, which was the highest closing price since October 23. Not to be outdone, spot silver rose by more than 4%, hitting its highest level since October 21. Driven by the dual impetus of weak U.S. economic data and rising expectations of a rate cut by the Federal Reserve, gold's safe-haven appeal as a non-yield-yielding asset has fully exploded.

Looking ahead to the market outlook, the future for gold is bright. I personally believe that by the end of this year, the price of gold may hover between US$4,200 and US$4,300 per ounce, while in the first quarter of next year, US$5,000 per ounce is still a reasonable target. This optimistic expectation is based on the continued path of interest rate cuts, economic uncertainty and geopolitical trade frictions. Although the stock market is rising on AI-related stocks such as Nvidia5.8%, Palantir surged 8.8%), led by a jump of 1.54%, the S&P 500 closed at 6832.43 points, Nasdaq rose 2.27%, but gold's status as a diversified asset is unshakable. The end of the government shutdown will release some economic pressure, but data gaps and disagreements with the Federal Reserve will continue to ferment. Gold will continue to shine, driven by the dual wheels of low interest rates and risk aversion. Investors should pay close attention to key data such as non-farm employment that will be released after the U.S. government ends its shutdown, as well as speeches by Federal Reserve officials and changes in market expectations for the December meeting.

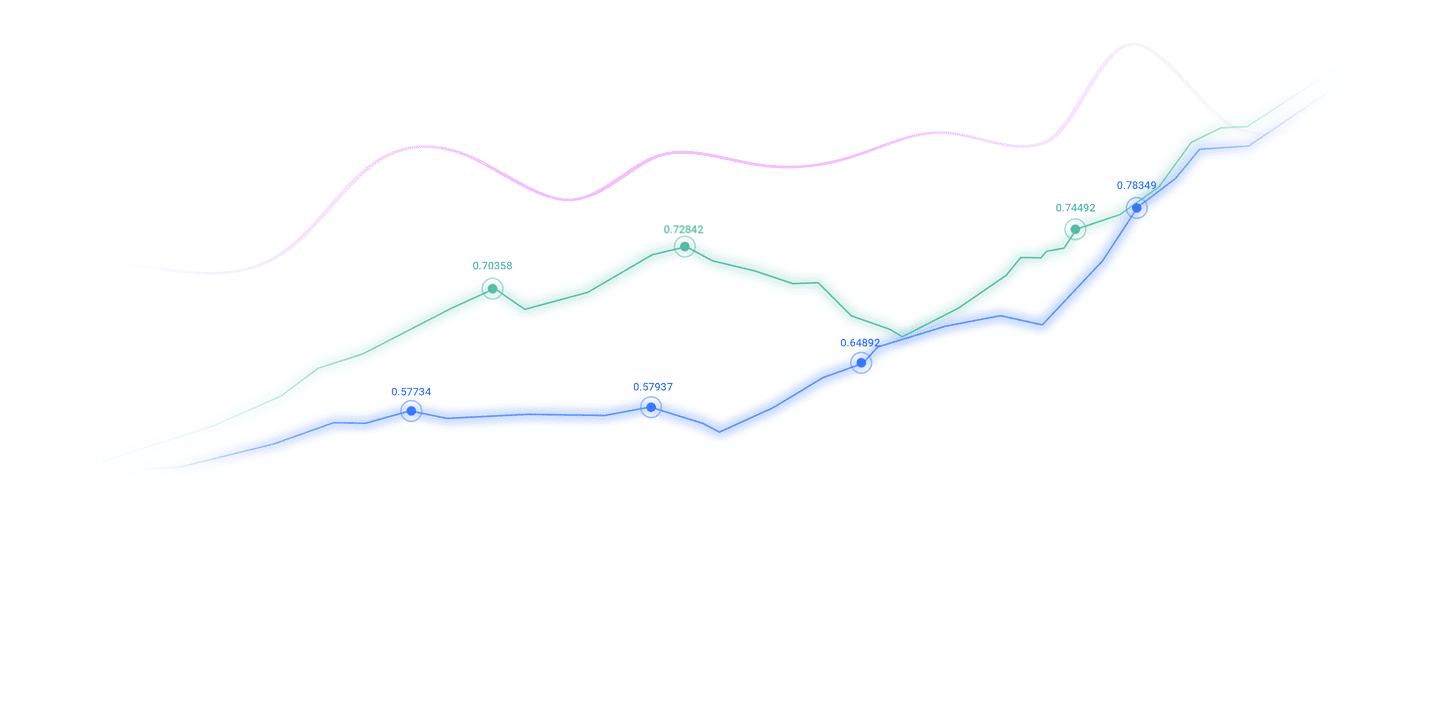

Gold technical analysis: Yesterday, gold once again had a strong upward trend. The trend is under the control of Lao Shi, and everyone has witnessed it! Yesterday, gold opened at 4001.4 US dollars. After the opening in the morning, gold It directly strengthened and rose, and it rose sharply to above $4,050 in the morning! The very strong market trend basically did not give any chance to step back and go long! Yesterday, Lao Shi also made a low long position below the $3,987 line, like this The market trend does not give any chance to step back! The only way to do it is to chase the long and enter the market, everyone has seen it! Gold continued to rise strongly in the European and American markets, and the US market rose sharply, reaching as high as $4116.5! It rose by $115 in a single day!

After the gold sun broke through, it went up unilaterally. It suppressed the decline near 4105 during the session and then formed a double bottom at 4076 and then pulled up to break a new high. The daily chart closed the bald sun line. From a trend perspective, it reached around 3930. The last inversion rebounded to a shock and rose yesterday. It officially broke through the middle track yesterday and is currently running towards the 0.5 position at 4135. This is also the key position today. Once it breaks through, the market outlook will extend upward to 4150-92-4218. Nearby, so there is no need to analyze how much the fallback is. The focus now is whether it can fall back and where it will fall. Now the gap on the daily chart is 4076, which is also a long and short point. The short-term support is here 4100-4082, so put 76-82 As the first level, 4100 is the first level, so the xmxyly.comprehensive conclusion is as follows: Today, there are many entries in the 4100-4110 area, the entry point, and 10 points of defense. The strength is 4120, which can be entered in one minute by turning around. The expected return It is exactly 5 minutes since the 200-day moving average here. The upward target is 4140 and the breakthrough is 4175-4192-4218. Today I saw 4218 and I made a short 10-point defense here. The target is 50-point bottom. Other points are to be determined. On the whole, today's short-term operation of gold, He Bosheng suggests to focus on the low and long rebound, supplemented by rebounding high. The upper short-term focus will be on the 4140-4160 first-line resistance, and the lower short-term will focus on the 4090-4070 first-line support.

Analysis of the latest crude oil market trend:

Crude oil news analysis: WTI continued to fluctuate around US$60/barrel on Tuesday, failing to extend the gains of the previous trading day; Brent crude oil remained at around US$64/barrel. The market lacks direction in the short term and investors are waiting for clearer signals. The relationship between supply and demand is showing signs of looseningFor example, the WTI spot spread narrowed to just 9 cents, the lowest since February. The spot spread reflects whether the market is short of near-term supply, and narrowing usually means demand is slowing and inventory pressure may rise. The core conflict in oil prices is shifting from "uncertainty on the demand side" to "whether the supply side will continue to rise." The technical side is waiting for a breakthrough, while the fundamentals - especially the continuous reports from OPEC and IEA - will determine the direction of the breakthrough.

Crude oil technical analysis: From the daily chart level, from the local level, the current oscillation rhythm of crude oil is a minor shock, and the previous main trend is three solid positive lines from the low of 55.96. Judging from the primary and secondary rhythms, there is still room for a rebound in the trend. The MACD indicator is below the zero axis, and bulls still need to further accumulate momentum. It is expected that after the mid-term trend of crude oil is supported by the backtest low, it is expected to form a rebound upward. The short-term (1H) trend of crude oil remains within a narrow range, with the range ranging from 61.50 to 59.30. Oil prices repeatedly crossed the moving average system, and the short-term objective trend direction fluctuated sideways unchanged. The MACD indicator is at the zero axis, and the long and short kinetic energy are stuck with each other. The trend of crude oil today remains consolidated, waiting for a breakthrough to establish direction. On the whole, today's crude oil operation thinking is based on He Bosheng's suggestion to rebound low and long, supplemented by rebounding high. The top short-term focus is on the 62.5-63.5 first-line resistance, and the bottom short-term focus is on the 59.5-58.5 first-line support.

This article is exclusively planned by He Bosheng, a gold and crude oil analyst. Due to the delay of network push, the above content is personal advice. Due to the timeliness of online publishing, the suggestions in this article are for learning reference only. You should operate at your own risk. Regardless of whether the views and strategies of the article agree with others, you can xmxyly.come to me to discuss and learn together! Nothing is difficult in the world, as long as there are people who are willing. Investment itself carries risks. I remind everyone to look for authoritative platforms and powerful teachers. Fund safety xmxyly.comes first, secondly consider operational risks, and finally how to make profits.

The above content is all about "[XM Foreign Exchange Market xmxyly.commentary]: Analysis of the latest market trend of gold falling from its high level on 11.12, exclusive operation advice and guidance for crude oil today". It is carefully xmxyly.compiled and edited by the editor of XM Foreign Exchange. I hope it will be helpful to your trading! Thanks for the support!

Live in the present and don’t waste your present life by missing the past or looking forward to the future.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here