Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- Gold, more than 3385!

- Australian dollar/USD hit a new high in 2025, bulls aim for a breakthrough in ch

- Trump threatens to significantly increase India's tariffs, turning to the servic

- The US dollar is at the heart, PCE inflation data stabilizes before release

- Guide to short-term operation of major currencies

market news

Gold continues to rise strongly, and if 4124 is a stable node tonight, it will continue to rise.

Wonderful introduction:

Life is full of dangers and traps, but I will never be afraid anymore. I will remember it forever. Be a strong person. Let "Strength" set sail for me and accompany me to the other side of life forever.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Platform]: Gold continues to rise strongly, and 4124 will continue to rise tonight as the node is stable." Hope this helps you! The original content is as follows:

Zheng's Point Silver: Gold continues to rise strongly, and 4124 will continue to rise tonight if it is stable as a node

Reviewing yesterday's market trend and technical points:

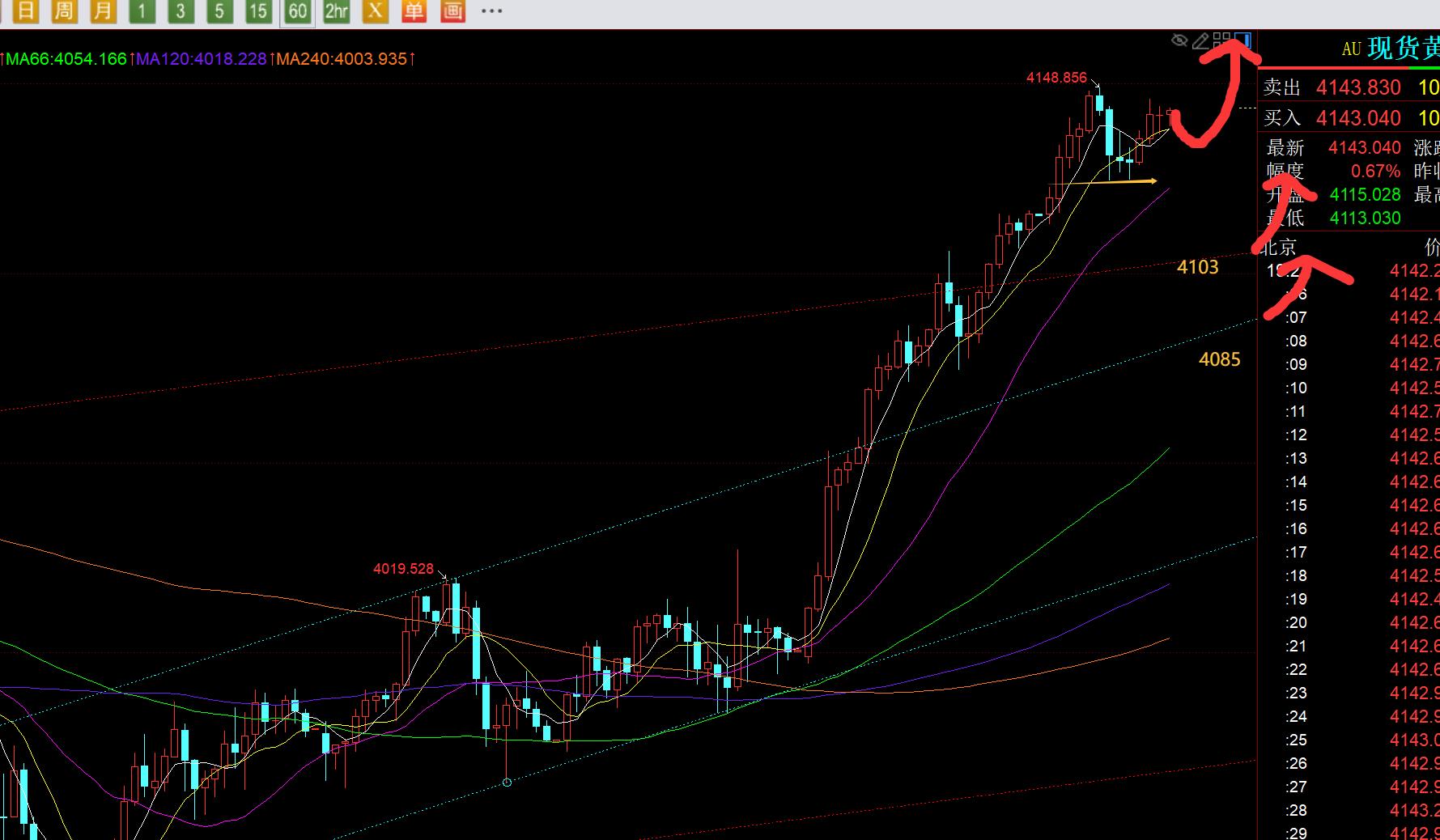

First, gold: it continued to squeeze shorts all day yesterday, and planned to hit 3990 early in the weekend to continue to be bullish, but it soared directly after opening around 4000; the European market planned to go up to 4060 If it is bullish, it will only be given to 4071; if the US market plans to be bullish at 4065, it will only be given to 4074. Bullish points are given many times throughout the day, but no chance is given; this short squeeze method returns to a point that has been repeatedly mentioned in the previous unilateral trend: If you boldly chase the rise at low prices in the early morning and grasp the opportunity, you will also try to chase boldly in the European and American markets later; on the contrary, if you dare not chase early in the morning, you will be bullish when you back up, and you will be short. Later, as the price gradually rises, you will naturally be less afraid to chase and continue to be short. ; But no matter what, the only thing you can't do is to be bearish, because it has broken through;

Second, in terms of silver: Similarly, the weekend plan is to be bullish at 48.2-48.1, and it will rise directly at the morning opening, which is also short; The U.S. market research report pointed out that if it wants to maintain its strength, it cannot fall below 49.65, which means that it continues to be bullish at this position. It has stepped back and tested in place, but did not pay attention to it, which is also a shortfall; however, the second high predicted at the weekend of 51 has already It’s in place, it belongs to 618;

Today’s market analysis and interpretation:

First, the golden daily level: Yesterday’s closing price was bald and full of Dayang K, and the closing station was above the mid-rail 4085, then this kind of It is basically an effective breakthrough because it is a big positive; subsequent retracement to confirm the middle rail, or piercing the middle rail and then pulling up are bullish opportunities at a low level. The next short-term resistance is to pay attention to the sideways resistance level that rebounded for three days after the big negative on October 21., focusing on 4161-4155-4144, and further up is the 618 division and the top and bottom positions of 4381-3886, focusing on 4192-4200, which is also expected to be at least the second highest point, and strong pressure is the 786 division 4275, I believe that the probability of directly setting a new historical high is unlikely. Before December 11, there is a high probability of maintaining a high level and a large convergence triangle correction operation; the purpose of the correction is still to prepare for the market outlook to further reach a new historical high and hit above 5,000; < /p>

Second, the golden 4-hour level: From yesterday to now, it has maintained a strong short-selling approach, relying on the 5-day moving average to pull up and break the high; therefore, tonight, focus on the 5th, moving up to the 4133 line, the resistance is the intraday high of 4148, temporarily short The time is not big, wait for the break; if it breaks upward, continue the strong pull to point to 4155-4161, 4192, etc.; if it breaks downward, make a short correction and pay attention to the 10 moving average 4105-4100 line to stabilize;

Third, the golden hourly level: it rose strongly overnight and closed at a high level. This unilateral move is likely to cause a wave of continued rise after the opening of the morning market on the second day. Those who get up early and are bold can take advantage of the wave first; the Asian market will rise for a wave of consecutive gains, and then fall back in the afternoon. The secondary support of 4124 stabilizes and breaks through the upper track resistance of the small cycle small convergence triangle, which will lead to an upward wave. Unfortunately, it has not broken a new high yet. It is difficult to judge whether the US market can rise again and see whether it can break through the high before 21 o'clock. Since the short cycle macd has seriously diverged, the high If the position is stagflation and does not break the high, it is not easy to chase the rise for the time being. Even if it breaks a new high, it is best to wait until it stabilizes above 4130-4124 before considering it. The mid-rail support will gradually move up to the European market low of 4124, which will become tonight's node. Feng Shui Ridge, if you stabilize it, it will continue to maintain It remains relatively strong; if it falls, it will undergo a brief downward correction. At that time, focus on the support of 4103-05 and the strong support of 4085-80, which are confirmation points of the upper track support of the previous upward channel. After the correction is pulled down, we must dare to be bullish;

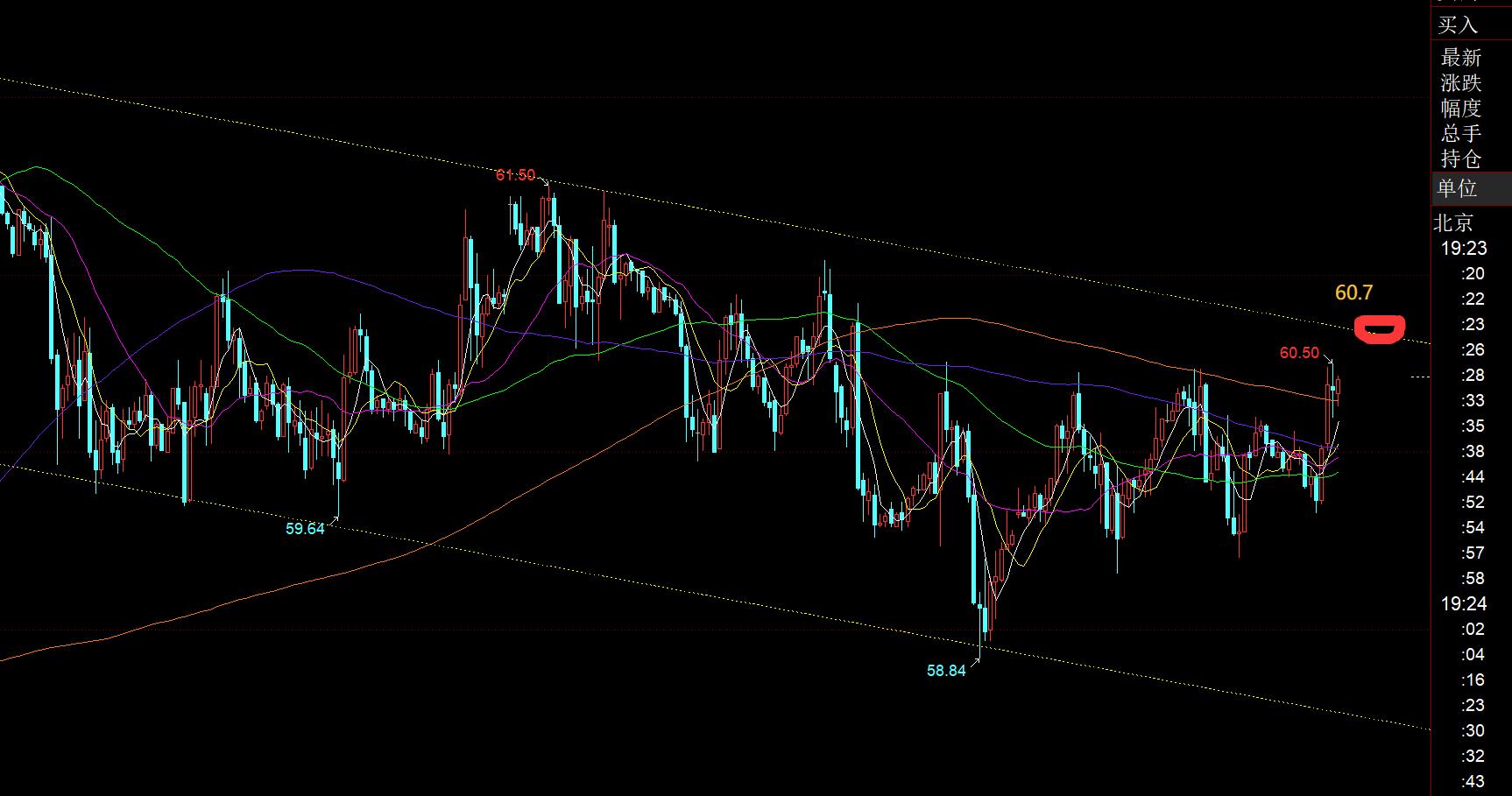

Silver: Yesterday it also closed with a strong sun, effectively breaking through the sideways pressure level of 49.4-49.5 in the previous ascending triangle, then it will become an effective top and bottom support for the market outlook, and continue to rise; today it has risen to the 51 line, and has reached the 618 division, the second high, earlier than gold. This implies from the side that silver It is stronger than gold, or there is still more room for improvement, pointing to the next division of 52.5. From the picture above, the Asian market also continued to rise, rose higher and fell in the afternoon, stabilized the hourly line and bottomed out, and is about to test the intraday high. In this way, the trend of the European market is still strong, and there will be a second rise tonight, which is obviously bullish than gold tonight; after 50.6-50.8 tonightContinue to be bullish. After breaking through 51.1, gradually move towards 52-52.5; that is, once it breaks through and reaches the upper track of the red channel, it will further open up the upside space;

In terms of crude oil: With the focus on the gains and losses of the upper track of 60.7 in the small channel, if it touches the pressure tonight, it will easily rise and fall, and continue to fluctuate back and forth;

The above are several views of the author's technical analysis. Operate, take good defense, and risk control xmxyly.comes first; if you don’t agree, just let it pass; thank you all for your support and attention;

[The opinions in the article are for reference only, investment is risky, you need to be cautious when entering the market, operate rationally, set losses strictly, control positions, and risk control is the first 1. Be responsible for profits and losses]

Writer: Zheng Shi Dian Yin

Read and study the market more than 12 hours a day for ten years. Detailed technical interpretations are made public on the entire network, and we serve with sincerity, dedication, sincerity, perseverance, and wholehearted service to the end! Write xmxyly.comments on major financial websites! Proficient in K-line rules, channel rules, time rules, moving average rules, segmentation rules, and top-bottom rules; student cooperation registration hotline - WeChat: zdf289984986

The above content is about "[XM Foreign Exchange Platform]: Gold continues to rise strongly, and tonight 4124 will be stable as a node and it will continue to rise." It is carefully xmxyly.compiled and edited by the editor of XM Foreign Exchange. I hope it will be helpful to your trading! Thanks for the support!

Due to the author's limited ability and time constraints, some contents in the article still need to be discussed and studied in depth. Therefore, in the future, the author will conduct extended research and discussion on the following issues:

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here