Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- The US and Japan finalize huge trade agreement but leave car tariff suspense, Pr

- Fed officials send a signal of interest rate cuts, the dollar index fluctuates n

- JPY under pressure, Fed hawkish risk may push USD/JPY up

- The daily and weekly resistance of gold lines is suppressed, and the gains and l

- The bears cannot catch up at $60 for a long time, and WTI may change its trading

market news

The temporary appropriation bill is about to pass the House of Representatives. Is the U.S. labor market still deteriorating?

Wonderful introduction:

Let me worry about the endless thoughts, tossing and turning, looking at the moon. The full moon hangs high, scattering bright lights all over the ground. xmxyly.come to think of it, the bright moon will be ruthless, thousands of years of wind and frost will be gone, and passion will grow old easily. If you have love, you should grow old with the wind. Knowing that the moon is ruthless, why do you always place your love on the bright moon?

Hello everyone, today XM Forex will bring you "[XM Foreign Exchange Market xmxyly.commentary]: The temporary appropriation bill is about to pass the House of Representatives, is the US labor market still deteriorating?". Hope this helps you! The original content is as follows:

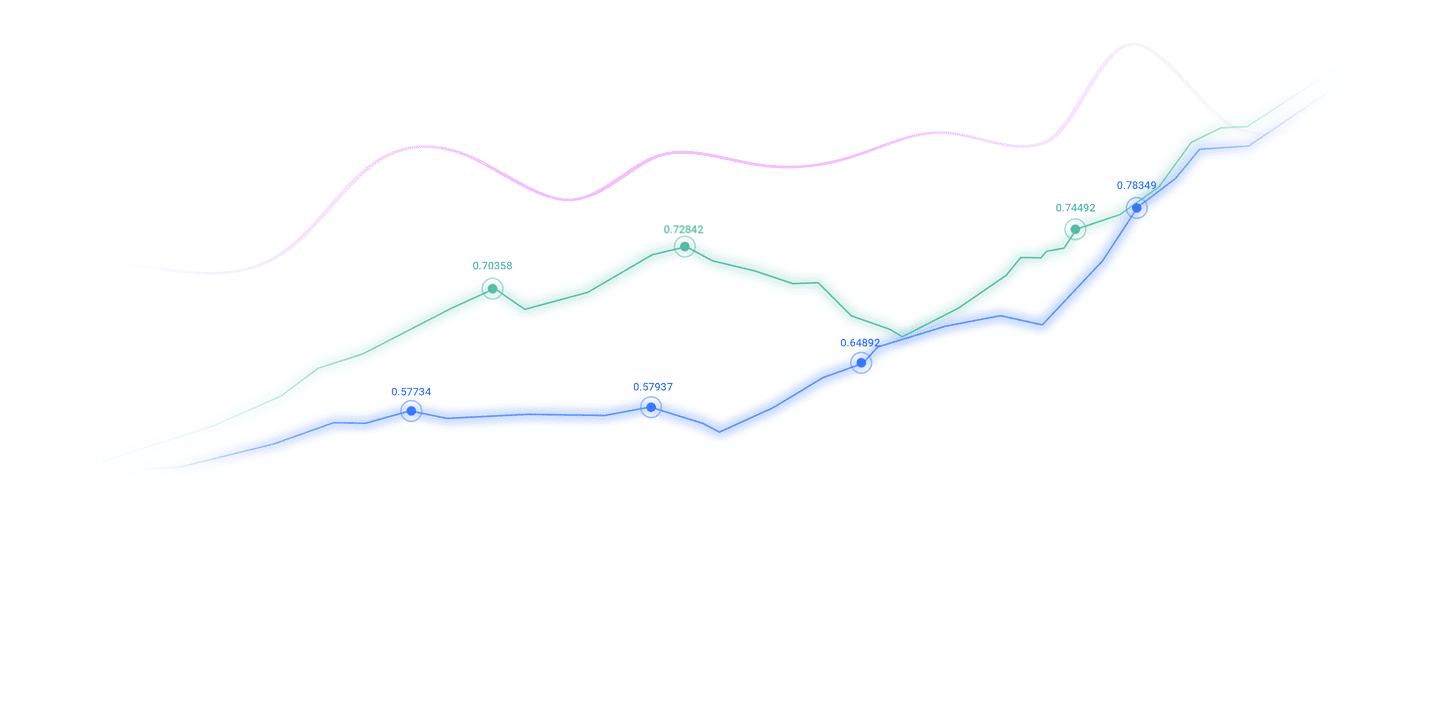

On November 12, in early trading in Asia on Wednesday, Beijing time, the U.S. dollar index was hovering around 99.48. On Tuesday, as the market was worried about the deterioration of the U.S. labor market, the U.S. dollar index continued to decline and plunged sharply before the U.S. market. However, it recovered some of its losses during the U.S. market and finally closed down 0.12% at 99.48; U.S. debt markets were closed for one day due to Veterans Day. Spot gold approached the US$4,150 mark many times during the session, hitting a new high in the past three weeks, but failed to reach here. Instead, it gave up some of its gains and finally closed up 0.26% at US$4,126.36 per ounce. Spot silver stood firmly above the US$50 mark, and finally closed up 1.4% at US$51.20 per ounce. Crude oil fell first and then rose. WTI crude oil started to rise during the European trading session. It once reached above US$61 during the session and finally closed up 1.72% at US$60.96/barrel. Brent crude oil finally closed up 1.79% at US$64.89/barrel.

Analysis of major currency trends

U.S. dollar index: As of press time, the U.S. dollar is hovering around 99.48. As employment data weakens and expectations of a Fed rate cut increase, the dollar may struggle to regain its upward momentum if upcoming government data fails to deliver a bullish surprise. Technically, if the dollar index remains below the 99.50 level, it will head towards the support level of 98.85–99.00.

Gold and crude oil market trend analysis

1) Gold market trend analysis

In Asian trading on Wednesday, gold hovered around 4138.96. Precious metals gained momentum amid further bets that the Federal Reserve will cut interest rates before the end of the year. Traders will be closely watching the Fed's speech later on Wednesday. The Fed's John Williams, Anna Paulson, Christopher Waller, Raphael Bostic, Stephen Millan and Susan Collins are scheduled to speak.

2) Crude oil market trend analysis

On Wednesday in the Asian market, crude oil was trading around 60.91. Oil prices rose on Tuesday, boosted by new U.S. sanctions on Russia and hopes of an end to the U.S. government shutdown, but gains were limited by concerns about oversupply. Investors need to pay attention to news related to the U.S. government shutdown. In addition, New York Fed President Williams, Philadelphia Fed President Paulson, Fed Governor Waller, Atlanta Fed President Bostic, and Boston Fed President Collins will each deliver speeches this trading day. Investors need to pay attention.

23:45 U.S. Treasury Secretary Bessent delivered a speech

The next day at 01:00 the EIA released its monthly short-term energy outlook report

The next day at 01:15 the Federal Reserve Bostic gave a speech

The next day at 01:30 Fed Governor Milan attended the event

The next day at 02:00 the United States to 1 10-year Treasury bond auction on January 12 - winning interest rate

02:00 the next day to 10-year Treasury bond auction on November 12-bid multiples

02:30 the next day the Bank of Canada released the minutes of the October monetary policy meeting

at 05:00 the next day the Federal Reserve Collins gave a speech on the outlook for the economic and financial situation

API crude oil inventories in the United States from 05:30 the next day to the week of November 7

The above content is about "[XM Foreign Exchange Market xmxyly.commentary]: The temporary appropriation bill is about to pass the House of Representatives, is the U.S. labor market still deteriorating?" It was carefully xmxyly.compiled and edited by the editor of XM Foreign Exchange. I hope it will be helpful to your trading! Thanks for the support!

Only the strong know how to fight; the weak are not even qualified to fail, but are born to be conquered. Hurry up and study the next content!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here