Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- The dollar continues to weaken, and the market focuses on key U.S. data

- Weekly rebound is coming, gold and silver continue to go long

- Dollar consolidates Fed-driven gains, Bank of Japan stimulates yen to strengthen

- 8.18 Gold market trend forecast and latest operation suggestions guidance layout

- Fed rate cut expectations heat up weakens dollar momentum and maintains a downwa

market news

The U.S. government shutdown eases and boosts demand in the oil market. The conflict between Russia and Ukraine continues, but cracks in sanctions appear

Wonderful introduction:

Let me worry about the endless thoughts, tossing and turning, looking at the moon. The full moon hangs high, scattering bright lights all over the ground. xmxyly.come to think of it, the bright moon will be ruthless, thousands of years of wind and frost will be gone, and passion will grow old easily. If you have love, you should grow old with the wind. Knowing that the moon is ruthless, why do you always place your love on the bright moon?

Hello everyone, today XM Forex will bring you "[XM Group]: The U.S. government shutdown eases to boost oil market demand, the Russia-Ukraine conflict continues, but cracks appear in sanctions." Hope this helps you! The original content is as follows:

On Monday (November 10), the easing of the government shutdown crisis boosted risk appetite, and the ongoing geopolitical conflict continued to inject a risk premium into oil prices. U.S. crude oil continued to rise by about 0.94% to around $60.30 per barrel.

Optimistic expectations of the Senate funding agreement to restart the government support oil prices

On November 9, local time, the U.S. Senate passed a temporary funding bill aimed at ending the government shutdown, which will provide funding for the government until January 30, 2026. November 9th, Eastern Time, is the 40th day since the U.S. government “shutdown” on October 1st.

The package being discussed would bundle an appropriations bill with three long-term spending bills and promise to give Democrats a separate vote on extending the health insurance tax credit.

Although the dawn has emerged, there are still variables in the restart of the US government. The Senate has not yet set a time for a final vote, and unanimous approval from all members is needed to speed up the process, with any member able to delay it for days through procedural means. House Speaker Johnson has promised to notify members 48 hours in advance of returning to vote, but the specific timetable is still unclear.

From a market perspective, expectations that approximately 800,000 unpaid federal employees will soon receive back pay, welfare programs will restart, and key government services will resume are boosting market sentiment.

The optimism surrounding the agreement can be confirmed by forecasting platforms such as Polymarket, which currently shows that the probability of the government shutdown ending between November 12 and 15 has exceeded 61%. Despite rising confidence, the deal still faces many hurdles. While the Senate appears close to reaching a deal, but still needs approval from the House of Representatives to end the longest government shutdown in U.S. history.

For the crude oil market, the government's restart is expected to boost demand for domestic goods and services (including energy) in the United States and resume suspended government spending, thereby supporting crude oil demand. In addition, improved risk appetite tends to weaken safe-haven premiums, prompting capital flows to xmxyly.commodities such as oil.

Russia launches large-scale attack on Ukraine

On Saturday, Russia launched a large-scale air attack on central and eastern Ukraine. According to Ukrainian authorities, the attack killed at least 4 people and injured 26 others.

The Ukrainian Air Force posted on Telegram on Saturday morning that Russia launched 503 projectiles overnight - including 458 drones and 45 missiles, of which 415 were shot down and the remaining 78 hit 25 different locations in Ukraine.

Ukrainian President Zelensky posted on Telegram last Saturday morning that the targets of Russia’s latest attacks remain the same: daily life, residential buildings, our energy systems and infrastructure.

The city of Dnieper was hit hard. According to the regional military administration, 3 people were killed and 11 others were injured. The casualties included children. A drone struck an apartment building in the city. Three other people were injured in the Samalsky district near Dnepropetrovsk Oblast, authorities said.

In the Kharkov region, at least one person was killed in the village of Rokitne; eight others were injured in the suburbs of Kharkov; one person was injured in Chuguyev Town; and one person was injured in the village of Grushivka, according to the Regional Military Administration. The mayor of Kharkiv posted on Telegram on Saturday morning that the city is facing a serious power shortage.

In addition, one person was injured in Poltava Oblast and another person was injured in neighboring Kiev Oblast. The military management departments of both places reported the above situations. Authorities said attacks on energy infrastructure in Poltava state left some xmxyly.communities without power, water and heating.

The Russian attack marks the ninth large-scale attack on Ukraine's fuel infrastructure since early October. Ukraine's state-owned energy xmxyly.company Naftogaz accused Russia in a Telegram post on Saturday morning of deliberately "targeting xmxyly.companies that provide fuel and heat to Ukrainians" during the winter.

The Russian Ministry of Defense posted a message on Telegram last Saturday morning confirming that Russian troops attacked Ukrainian military and energy infrastructure at night. The Russian Defense Ministry said that this "large-scale strike" was a response to "Ukraine's terrorist attack on civilian facilities in Russia."

The ongoing Russia-Ukraine conflict provides a risk premium to oil prices.

Trump considers excluding Hungary from Russian oil sanctions

U.S. President Trump told Hungarian Prime Minister Viktor Orban on Friday that the United States is "considering" exempting Hungary from sanctions on Russian oil, a move that weakens the United States' remaining concrete role in Russian energy exports.It is one of the levers of significance, and it also sends a flexible signal to allies who have long been at odds in the energy chess game.

The exemption negotiations began just as Ukrainian President Zelensky vowed to cut off Russia’s oil pairing with Hungary through the Druzhba pipeline. Zelensky said the oil flow "will disappear from Europe" as Kiev moves to prevent Russia from financing the conflict through energy exports.

However, Hungary's top refiner MOL said that up to 80% of its crude oil is now available from non-Russian suppliers, a sharp contrast to its stance two years ago that it was impossible to diversify.

Hungary currently relies on Russian crude oil for about 86% of its oil supply, and its refineries were also built to process Russian Ural blended oil. Replacing raw materials means expensive equipment modifications and higher input costs, but the latest statement from MOL Group implies that its actual progress has far exceeded the extent publicly acknowledged by the Budapest authorities. If true, this statement would weaken Orban's argument that "the lifting of sanctions is crucial to Hungary's energy security."

Trump’s willingness to discuss exemptions is nothing new. In both his domestic and foreign policies, he has long used the flexibility of his public stance as a negotiating tool—both to keep opponents guessing and to win concessions. The move could be a signal to Brussels, Kiev and even Moscow that Washington wants to contain all three at the same time.

For the oil market, the direct impact of the exemption on the actual flow of the Druzhba Pipeline is limited, because its supply accounts for a relatively small proportion of the world. But this could set a dangerous precedent - if Hungary receives special treatment, other countries that rely on Russian crude (such as Slovakia) may follow suit.

This move will weaken the credibility of the sanctions regime and further blur the lines between geopolitics and energy pragmatism. The political signal it sends may weaken the effectiveness of sanctions against Russia in the medium to long term, thereby limiting the upside space for oil prices.

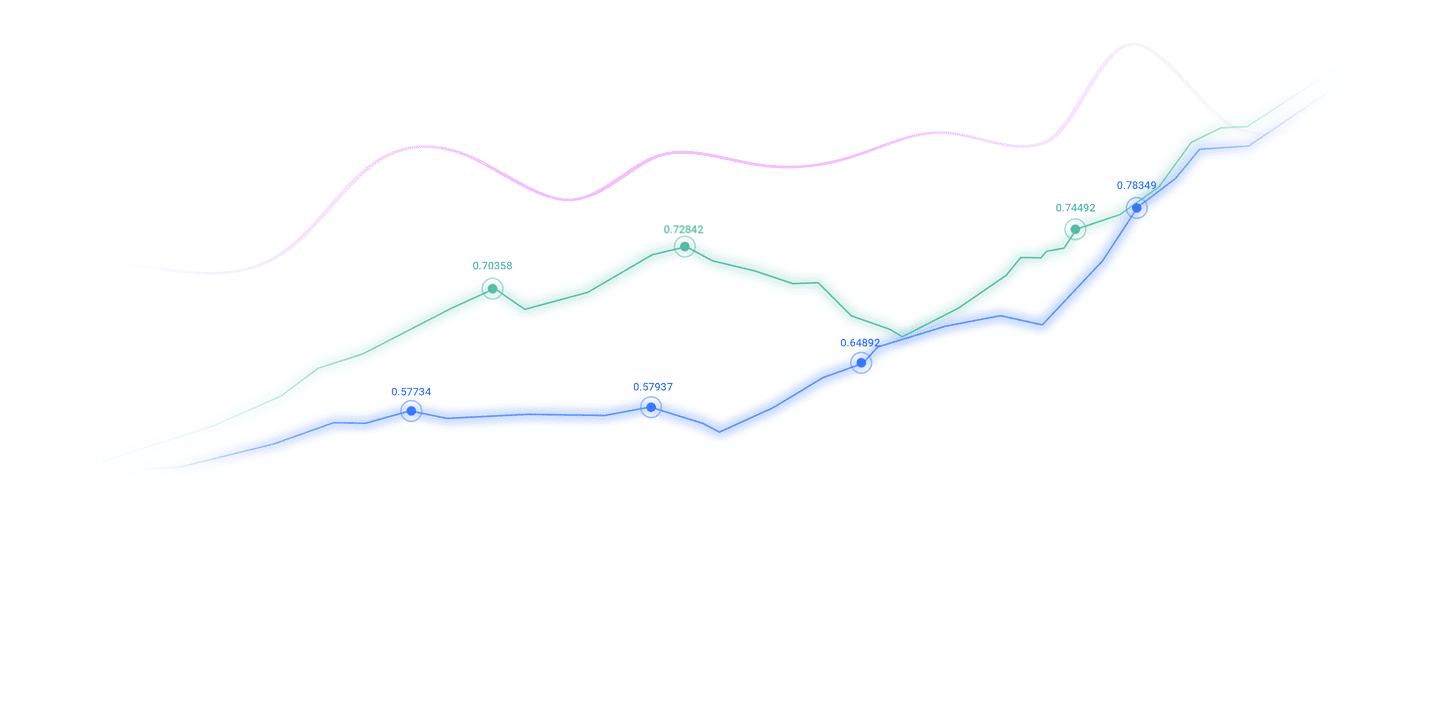

Technical Analysis

Oil prices are currently hovering near the middle of the three-year downtrend channel and the middle of the five-month channel, becoming a key short-term and long-term reference point as the market responds to supply uncertainty and labor market risks in 2026.

On the upside, the first resistance is located near the short-term channel of $63, and then $66.80. If this point is effectively exceeded, the potential increase will be expanded to the upper track of the long-term channel of $70, which indicates that crude oil may have a sustained structural recovery in the next few years.

On the downside, if it is confirmed that it falls below the lower track of the short-term channel of 54.50 and the annual low of $55, it may open a channel for further testing of the lower edge of the channel near $49, and another round of technical rebound may occur.

The above content is all about "[XM Group]: The US government shutdown eases the demand for oil market, the conflict between Russia and Ukraine continues, but cracks in sanctions appear". It is carefully xmxyly.compiled and edited by the editor of XM Foreign Exchange. I hope it will be helpful to your trading! feelThanks for the support!

Only the strong know how to fight; the weak are not even qualified to fail, but are born to be conquered. Hurry up and study the next content!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here