Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- Trump threatens to fire Fed director Cook again, Russia-Ukraine peace agreement

- Gold remained weak and fluctuated, and the rebound peaked and continued to be sh

- Gold, more than 3385!

- The US dollar index breaks through the 98 mark, and a new round of negotiations

- The latest trend analysis of the US dollar index, yen, euro, pound, Australian d

market analysis

A collection of good and bad news affecting the foreign exchange market

Wonderful introduction:

Without the depth of the blue sky, you can have the elegance of white clouds; without the magnificence of the sea, you can have the elegance of the creek; without the fragrance of the wilderness, you can have the greenness of the grass. There is no bystander seat in life. We can always find our own position, our own light source, and our own voice.

Hello everyone, today XM Forex will bring you "[XM Official Website]: A collection of good and bad news affecting the foreign exchange market". Hope this helps you! The original content is as follows:

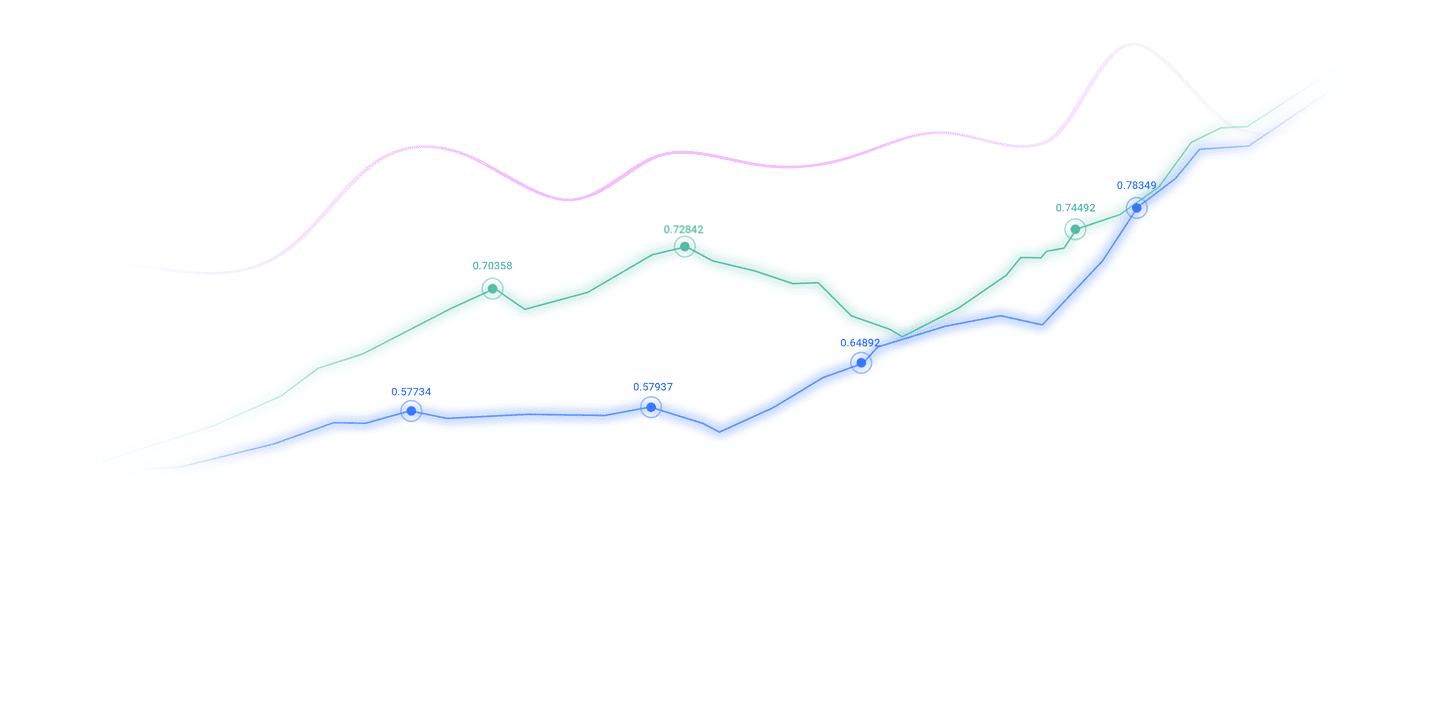

1. Panoramic view of long and short news on core currency pairs

On November 11, the foreign exchange market was affected by multiple factors such as the divergence of global central bank policies, the collapse of crude oil prices, and the cooling of geopolitical risks. The major currency pairs showed the characteristics of "the U.S. dollar is strong but not strong, and non-U.S. divergence and shock". As of the close of the Asian session, GBP/USD was at 1.3170 (+0.17%), EUR/USD fell slightly to 1.1552 (-0.05%), USD/JPY rose to 151.20 (+0.21%), offshore RMB/USD was stable at 0.1404, and long and short forces were engaged in a fierce game at key points.

2. The U.S. dollar is a currency: good news supports resilience, bad news restricts growth

(1) Good news: cautious policy + highlighted risk aversion properties

Expectations for the Federal Reserve to "pause interest rate cuts" are rising: U.S. policy The government shutdown led to the delay in the release of key data such as CPI and non-farm payrolls in October. Fed Vice Chairman Jefferson made it clear that "without data support, an interest rate cut in December is not a certainty." The market's probability of an interest rate cut in December dropped from 72% at the beginning of the month to 66.9%. Policy uncertainty coupled with a "data vacuum" has kept the U.S. dollar index resilient above the 105 mark, directly suppressing oil prices.

Global safe-haven funds are returning: On November 11, WTI crude oil plunged nearly 2% and fell below $60. The crude oil volatility index (OVX) rose to a three-year high of 45%. Coupled with the rising Sino-US trade friction, funds poured into U.S. dollar assets for safe haven, pushing USD/JPY to break through the key resistance level of 151.

(2) Bad news: internal differences + economic worries

Differences between eagles and doves weaken policy oneConsistency: Cleveland Fed President Hammack warned that "further interest rate cuts will trigger a rebound in inflation," while Governor Waller emphasized the need to continue cutting interest rates to prevent the economy from cooling. The opposing stances made it difficult for the U.S. dollar to form a trend upward trend, and the EUR/USD did not fall below the 1.1548 support level.

The economic outlook is clouded: U.S. xmxyly.commercial crude oil inventories have grown more than expected for two consecutive weeks, coupled with the suppression of consumption and investment caused by the government shutdown, the market is worried about slowing economic growth, limiting the upside space of the U.S. dollar index, making it difficult to break through the previous high of 105.50.

3. European currencies: The euro is under obvious pressure, and the pound has hidden opportunities

(1) The euro is dominated by bad news: policy wait-and-see + oil price drag

The European Central Bank "stands still" to curb easing expectations: ECB management xmxyly.committee member Vujcic said that the current monetary policy is "in good condition". Although inflation in the Eurozone rose slightly to 2.2% in September, institutions generally judge that interest rates will not be cut before the end of the year. Policy certainty has given the euro bottom support at 1.1540, but it lacks upward momentum.

Energy and trade are under dual pressure: As a major importer of crude oil, the Eurozone has been affected by the plunge in oil prices, and expectations for a narrowing of the energy trade deficit have cooled. At the same time, the escalation of Sino-US trade friction has impacted Eurozone export expectations. The Sentix investor confidence index in November did not meet expectations, and the Euro/USD maintained a narrow range.

(2) The pound is positive: the difference in interest rate cut expectations opens up space

The Bank of England leads the developed economies in the probability of interest rate cuts: Although the British inflation rate reaches 3.8%, Bank of England Governor Bailey hinted that "the December resolution will be taken into account in the fiscal budget." Institutions predict that the probability of an interest rate cut in December is over 50%, significantly higher than the Federal Reserve and the European Central Bank. The difference in expectations of policy easing pushed GBP/USD up to 1.3170 in early trading, becoming an "alternative" among European currencies.

4. xmxyly.commodities and Emerging Market Currencies: The plunge in oil prices has become a major negative factor

(1) Negative factors: crude oil drag + US dollar suppression

Resource currencies are under collective pressure: WTI original Oil hit a five-month low, and the IEA lowered its demand growth forecast for 2025 to 700,000 barrels per day. xmxyly.commodity currencies such as the Australian dollar and Canadian dollar weakened, and the Australian dollar/US dollar fell to around 0.6350, down 0.3% from the previous day.

Emerging market central banks are cautiously waiting: Central banks in emerging markets such as Brazil and Malaysia have continued to keep interest rates unchanged. The Brazilian central bank emphasized the need to be wary of U.S. tariffs and geopolitical risks. The conservative policy stance is difficult to attract capital inflows, and currencies such as the RMB and the real remain range-bound.

(2) Positives: Local policies and valuation support

Offshore RMB valuation returns to rationality: Despite the strength of the U.S. dollar, the offshore RMB/U.S. dollar is stable at 0.1404, with a fluctuation range of less than 0.2% from the previous week, reflecting the resilience of the domestic economy and expectations of central bank exchange rate adjustment, becoming a "stabilizing anchor" among emerging market currencies.

5. Key events of concern

Progress of data release: if the U.S. governmentRestart, October's CPI and non-agricultural data will be the key to the Fed's policy shift, directly affecting the trend of the US dollar;

OPEC+ and sanctions dynamics: U.S. sanctions on Russian crude oil will take effect on November 21. If supply disturbances are caused to push up oil prices, it will indirectly ease the pressure on xmxyly.commodity currencies;

Central Bank Speech: The speech of Federal Reserve Chairman Powell on the evening of November 11 needs to be focused on. If the "patient wait and see" signal is released, it may intensify the dollar's volatility.

Generally speaking, the foreign exchange market is in a pattern of "the U.S. dollar's resilience remains unchanged and non-U.S. differentiation intensifies" on November 11. Investors need to focus on the linkage effect of central bank policy differences and crude oil, and at the same time be wary of the risk of soaring volatility during the data vacuum period.

The above content is all about "[XM official website]: Collection of good and bad news affecting the foreign exchange market". It is carefully xmxyly.compiled and edited by the XM foreign exchange editor. I hope it will be helpful to your trading! Thanks for the support!

Every successful person has a beginning. Only by having the courage to start can you find the way to success. Read the next article now!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here